Idea of the Day

The single currency is standing out this morning, again pushing new highs for the year after pushing above the 1.38 level during Asia trade. Theirs is a reluctance to this rally, with volumes on the institutional side (bank reports) suggesting that large investors are very reluctant to chase the euro higher. But as we’ve pointed out before, the euro remains the second most liquid currency after the US dollar and when investors are generally pushing back on the dollar, in part based on fiscal concerns, the euro stands to benefit more. The question is whether European officials are going to start “talking down” the currency. This is one of the risks. There were words when we were around the 1.35-36 area back in Feb, but the issue is that this is mostly a story of dollar weakness, so even if officials do try and talk down the currency, the effect is likely to be transitory at best.

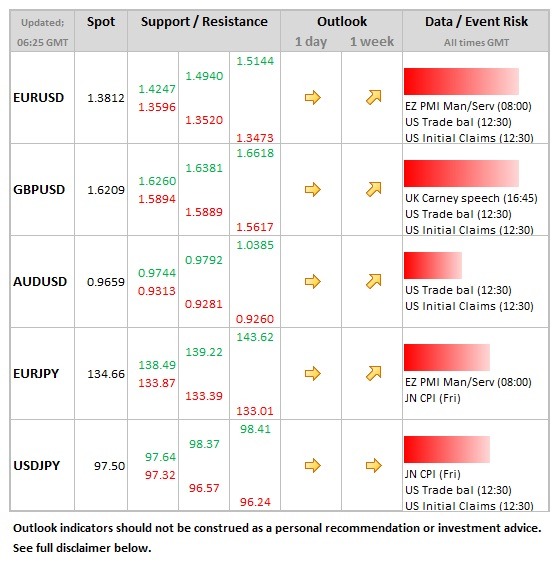

Data/Event Risks

EUR: The advance PMIs can and do impact the single currency as they are the earliest indication of economic activity and sentiment in the Eurozone for the month of October. Expectations are for the Eurozone manufacturing series to rise from 51.1 to 51.4, with services measure steady at 52.2.

USD: The weekly claims data are seen lower, but the data has been impacted by the recent government shutdown so are not going to give a clear read of the underlying health of the US economy and the dollar likely to shrug off the release.

Latest FX News

AUD: The sense that the Aussie is looking a little tired after recent gains remains in place, with AUDUSD holding below the 0.9700 level for the time being. The 0.9724 level represents the 50% retracement of the range of the year and although we did break through, this was already at a time when EUR-USD was looking over-bought.

JPY: A steadier tone emerging on the yen for the time being. The move below 98.00 on USDJPY has been sustained. CPI data will be the focus for Thursday.

CNY: The HSBC manufacturing PMI data for October rising modestly overnight (from 50.2 to 50.9, but rising money market rates are cause for concern, resulting in volatility in Chinese equities and elsewhere.

Further reading:

French PMIs disappoint, Spanish unemployment slides – EUR/USD holds on to 1.38