- EUR/USD has been reaching the limits of its advance.

- Optimism about Sino-American relations counter fears of EU-US deterioration.

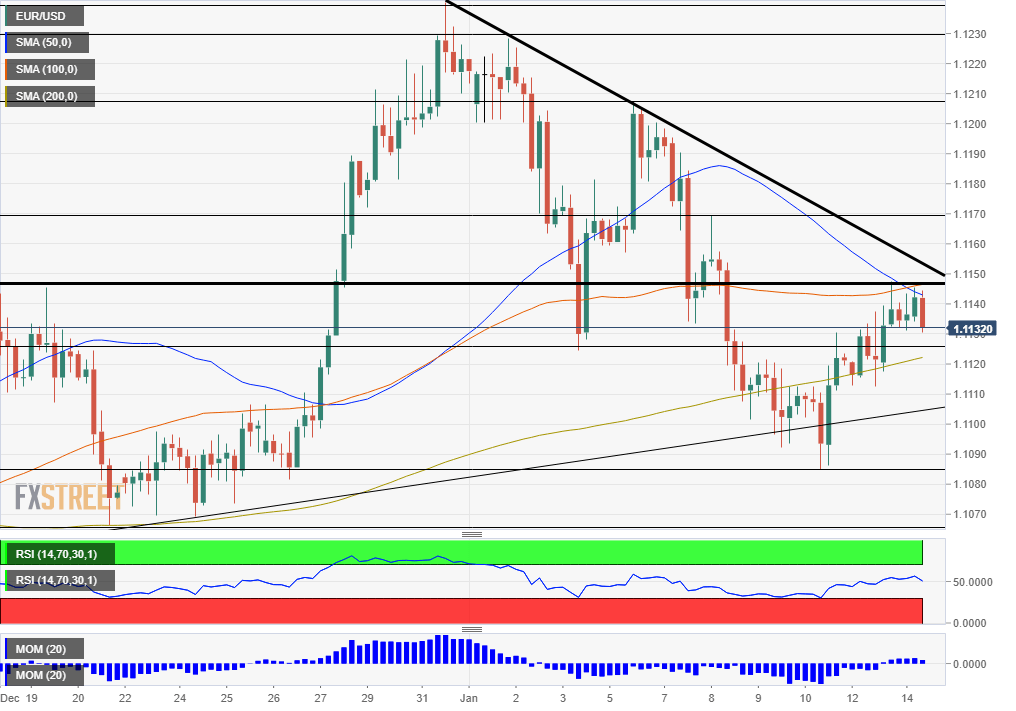

- Tuesday’s four-hour chart is pointing to a critical confluence resistance line.

One trade spat is cooling but another one could kick off – this time directed against Europe. EUR/USD is caught in the middle between optimism about Sino-American relations and new US-EU negotiations.

Starting from the good news, America’s Treasury removed the label “currency manipulator” from China – in what seems like a gesture of goodwill ahead of Wednesday’s signing ceremony of Phase One of the trade deal. In a statement, Washington says it has guarantees that Beijing will not meddle with the value of the yuan.

Markets are cheering the move and the safe-haven dollar is coming under a tad of pressure. Investors are eager to see the agreement between the world’s largest economies, which will reportedly consist of Chinese commitments to purchase significant amounts of American goods. Liu He, China’s Vice Premier, is leading a delegation to Washington.

On the other hand, Europe’s chief trade negotiators Phil Hogan is also in the American capital for three days of negotiations. The “tech taxes” imposed by several European countries, auto tariffs, and other topics are all on the table. Some fear that once President Donald Trump reached a deal with China, he may direct his ire to the old continent.

Beyond trade

Ursula von der Leyen, President of the European Commission and Hogan’s boss, is scheduled to unveil Europe’s Green Deal – which may reach one trillion euros in public and private spending. Investment in the environment can boost the economy, but some are skeptical that Germany would allow debt-spending.

Raphael Bostic, President of the Atlanta branch of the Federal Reserve, has reaffirmed the bank’s stance of staying put, saying that monetary policy is appropriate. His peer John Williams of the New York Fed will speak today.

Both will be eying the Consumer Price Index report for December, which is projected to show that Core CPI remained at 2.3% yearly – not too hot, nor too cold.

See preview The inflation sideshow

Overall, trade and inflation are set to dominate trading today.

EUR/USD Technical Analysis

Euro/dollar is capped by a quadruple confluence around 1.1150, which includes the 50 and 100 Simple Moving Averages on the four-hour chart, the weekly high, and downtrend resistance which is zooming into the current price.

Break or bounce? Other indicators are marginally positive as the pair trading above the 200 SMA and enjoying upside momentum.

Above 1.1150, the next caps are at 1.1170, 1.1205, 1.1230, and 1.1240, which all were stepping stone on the way down since Christmas.

Support awaits at 1.1125, which was a swing low in early January. It is followed by 1.1190, the 2020 low, and then by 1.1165, which cushioned EUR/USD in late December.