Idea of the Day

The Vetrans day holiday in the US will keep volatility on the low side today. In the background, there is the issue of policy divergence between the US and Eurozone. The US has seen stronger data (GDP, payrolls) whilst the ECB threw a surprise rate cut into the mix last week. But does this mean that a weaker EURUSD will follow. The initial reaction suggested yes, but beyond this there are two issues. Firstly is the actual impact on the economy from the move. This is likely to be limited, as was the case for the previous easing back in May, which saw a very limited fall in rates paid by households and businesses. Beyond that is the actual impact of the move on the currency. As was the case mid-year, there are some suggesting that this will mean a notably weaker euro. But countries beset by very low or negative inflation have often seen strong currencies (such as the yen and Swiss franc). Both Japan and Switzerland have undertaken policies to weaken their currencies in the past couple of years, but both by routes that would be very difficult for the ECB to go down.

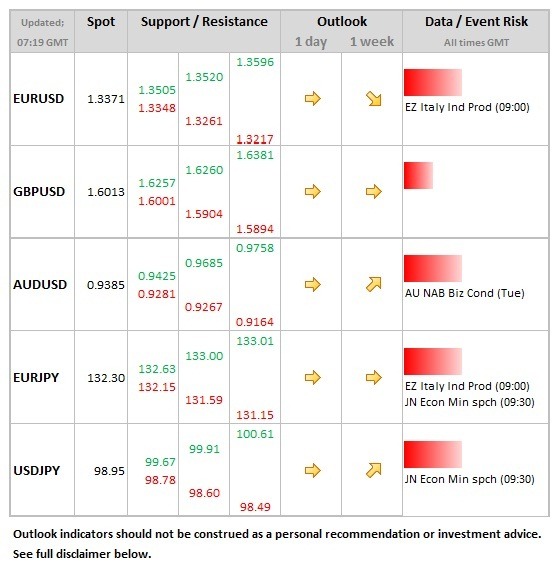

Data/Event Risks

FX: Vetrans day holiday in the US will keep activity subdued today, with data releases scheduled for the Eurozone (Italy production) not likely to add to volatility. Main focus this week is with sterling on Wednesday, with expectations of upward revision to growth and employment forecasts.

Latest FX News

USD: Both the GDP and labour market data supporting the dollar towards the end of last week, but both releases came with health warnings. The GDP risks falling back in the 4th quarter as inventories correct lower and the shut-down impacts. Labour market data could also see further adjustment from the shutdown in next month’s release.

GBP: Once again, sterling is left struggling to push above 1.60 against the dollar on a sustained basis, with the onslaught of firmer than expected data from the US last week causing the latest correction. The Inflation Report on Wednesday this week will be key and may instigate a stronger sterling tone if growth and employment figures are revised higher.

AUD: Data on home loans, released overnight, was firmer than expected, showing a rise of 4.4% in September. The Aussie was steady in Asia trade, more mindful of the noises of concern emanating from the RBA over the past 2 weeks regarding the strength of the currency.

Further reading: