No surprises or perhaps a small negative surprise given the German figures: the euro-zone remains in deflation with prices falling 0.1% y/y in March. While slightly better than the fall of 0.2% in February, this isn’t really good news. Core inflation also rises, and also as expected, to 1% y/y from 0.8% beforehand.

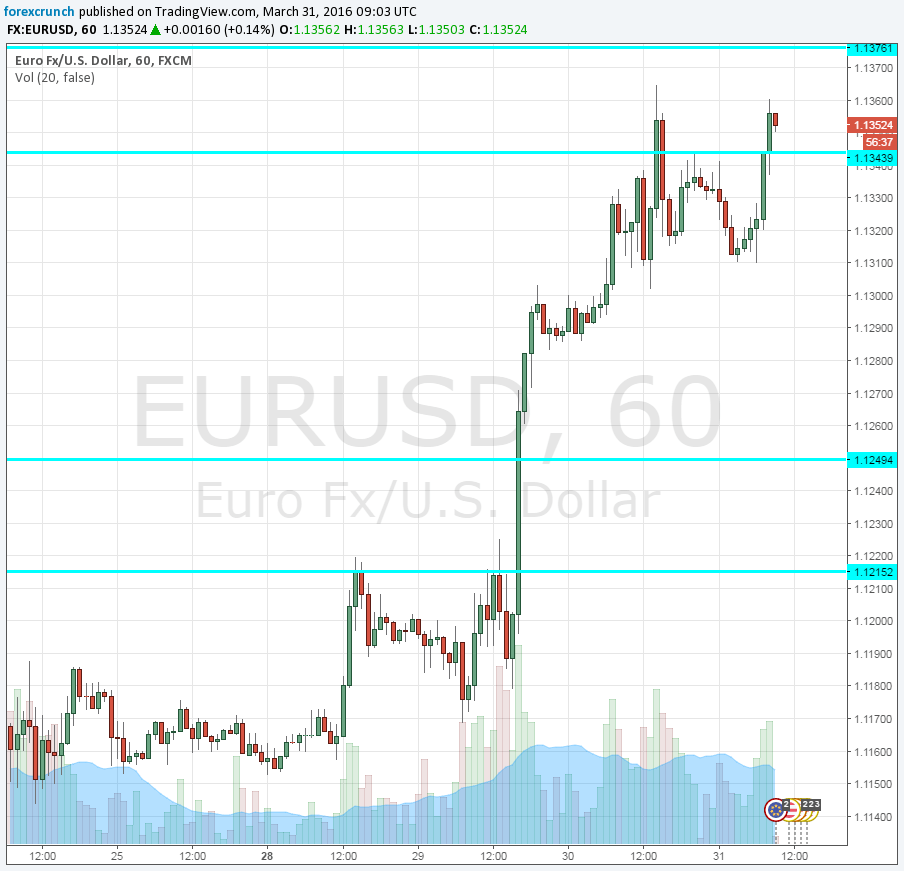

EUR/USD slips a few pips but remains on high ground. The worse than expected data does not hurt the euro to much this morning, as the US dollar remains quite weak.

The euro-zone was officially expected to report an inflation rate of -0.1% y/y in the preliminary report for March after a depressing -0.2% in February. However, due to the beat in German inflation data and despite the miss in the Spanish figures, real expectations were probably higher. Core inflation was predicted to rise 1% y/y after a revised up 0.8% in February.

EUR/USD was on the move ahead of the publication, trading around 1.1355 after already reaching 1.1360. Resistance awaits at 1.1375, the high line reached in mid February, when doom and gloom was at its peak.

The pair is trading on this high ground mostly thanks to Janet Yellen’s very dovish speech on Tuesday. Speaking in New York, the Chair of the Federal Reserve saw the glass half empty, warning about the global economy, saying the inflation outlook has become more uncertain and regarding rates, she said the caution should be “especially” warranted. This contrasted many of her colleagues’ more hawkish comments last week.

Earlier today, German employment figures slightly disappointed. There was no change in the number of unemployed, contrary to an expected drop of 7K. The labor market in Germany is still looking good, and the unemployment rate remains at 6.2%. However, the pay in Germany is nothing to get excited about: in former East Germany, many belong to the emerging “working poor” class.