EUR/USD remains steady in Tuesday trading, but the Cyprus bailout continues to preoccupy the markets. The euro plunged on the weekend, following the announcement that a 10 billion euro bailout for Cyprus would include a one-time tax on bank deposits. The Cypriot government is trying to soften the bank levy, and a vote in parliament on the bailout has been postponed. In economic news, Italian Industrial Production hit a five-month high. German ZEW Economic Sentiment sparkled, posting its highest level since 2010. However, Eurozone ZEW Economic Sentiment slumped badly. In the US, there are only two releases on Tuesday, both being important housing indicators – Building Permits and Housing Starts.

Here is a quick update on the technical situation, indicators, and market sentiment that moves euro/dollar.

EUR/USD Technical

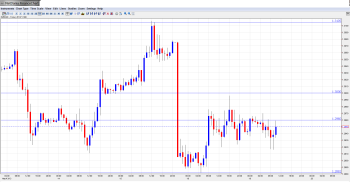

- Asian session: Euro/dollar moved lower, dropping to 1.2934. The pair consolidated at 1.2945. In the European session, the pair has edged lower.

- Current range: 1.2880 to 1.2960.

Further levels in both directions:

- Below: 1.2880, 1.2805, 1.2746, 1.27, 1.2660 and 1.2587.

- Above: 1.2960, 1.3000, 1.3100, 1.3130, 1.3170, 1.3255, 1.3290, 1.3350, 1.34, 1.3486 and 1.3588.

- 1.2960 is the next line of resistance. 1.3000 stronger.

- 1.2880 is a strong support level.

Euro/dollar steady as Cypriot worries continue – click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 Italian Industrial Production. Exp. 0.3%. Actual 0.8%

- 10:00 German ZEW Economic Sentiment. Exp. 47.9 points. Actual 48.5 points

- 10:00 Eurozone ZEW Economic Sentiment. Exp. 43.7 points. Actual 33.4 points

- 12:30 US Building Permits. Exp. 0.93M

- 12:30 US Housing Starts. Exp. 0.92M

For more events and lines, see the Euro to dollar forecast

EUR/USD Sentiment

- Cyprus bailout sends markets into turmoil: The small island of Cyprus is not used to being in financial headlines, but it is reluctantly in the spotlight this week. Over the weekend, a bailout agreement was reached over the weekend between the EU, IMF and the Cypriot government in the amount of 10 billion euros. However, a controversial provision in the agreement sent the euro spinning southwards. Under the terms of the bailout package, deposit holders in Cypriot banks would be levied with a one-time tax, between 6.7% and 9.9%, depending on the size of the deposit. This tax is intended to raise 5.8 billion euros, covering more than half of the 10 billion euro bailout. Taxing bank deposits is unusual ,and could result in depositors in other Eurozone countries with high debts to move their funds to countries such as Germany. Cypriots were understandably in an uproar, as this marked the first time in the Eurozone debt crisis that bank depositors were being asked to take a haircut as part of a bailout. There was a run on bank machines, as Cypriot banks were closed for a holiday. The Cypriot parliament was scheduled to meet in an emergency session on Tuesday to vote on the bank deposit levy, but this vote has been postponed as the goverment feared it did not have enough support to approve the bailout.

- US ends week on a whimper: A solid week for US releases ended on a sour note, as Friday’s numbers were a big disappointment. Earlier last week, employment and retail sales data looked sharp, but Friday was a different story. UoM Consumer Sentiment dropped to 71.8 points, and was way below the estimate of 78.2 points. The Empire State Manufacturing Index also lost ground, falling to 9.2 points, and missed the estimate of 9.8 points. There was some good news, as Industrial Production was higher, rising 0.7%. This beat the estimate of 0.4%. The markets will be hoping for a rebound on Tuesday, with the release of Building Permits and Housing Starts.

- Italian Political Deadlock Continues: The political stalemate which has paralyzed Italy for several weeks continues. Even by Italian standards, the political puzzle is bewildering, and the only solution may mean yet another election. Most Italians oppose going back to the polls, but so far, the political leaders have not made any headway as far as forming a new government. Italian President Giogio Napolitano has asked Prime Minister Mario Monti to stay on until the political crisis subsides. The financial markets are increasingly concerned that the ongoing political impasse will lead to an economic crisis in the Eurozone’s third largest economy. Last week, Italy’s three-year borrowing costs rose to their highest level since December. This comes on the heels of a recent credit downgrade to Italy’s debt by the Fitch rating agency.

- Draghi optimistic, markets less so: ECB head Mario Draghi has all but guaranteed that the Eurozone economy will turn around later this year, but the markets are skeptical. Eurozone numbers continue to look sluggish, with Germany one of the few bright spots. Speculation continues that the ECB may pull the trigger and reduce interest rates if things don’t start to improve shortly. Meanwhile the Fitch ratings agency recently downgraded the debts of Italy and Spain, as well as Belgium, Cyprus, and Slovenia. The euro will have a tough time trying to gain ground if market sentiment on the Eurozone economy does not improve.

- Markets keep on Federal Reserve: The Federal Reserve meets for a policy meeting on Wednesday. The markets will be all ears with regard to the current round of QE. With the US recovery looking stronger and unemployment nudging lower, there has been speculation that the Fed might wind down or modify its asset purchasing program. However, Fed head Bernard Bernanke and other senior officials have said QE will continue as is. If the Fed surprises the markets, we can expect a reaction from EUR/USD.