EUR/USD did manage to lift its head following some weak US data but this may not last. The team at CIBC focuses on Europe and sees reasons not to be cheerful for the euro’s prospects.

Here is their view, courtesy of eFXnews:

Brushing aside concerns over the region’s banking sector and Brexit, the EUR has performed reasonably well over the past month. Indeed, the common currency has capitalized on the recent bout of USD malaise while also continuing to benefit from its current account surplus. Additionally, the flash estimate of Q2 growth saw the Eurozone economy expand by 1.6% year/year””not an impressive number by historical standards but still good enough to eclipse the underwhelming 1.2% for the US. Still, all is not well in the Eurozone. The growth number masks an underperforming Italian economy that remains suspect ahead of a crucial constitutional referendum in November. The referendum itself has turned into a de facto vote of confidence in current PM Matteo Renzi and could open the way for the eurosceptic ‘Five Star’ party to gain prominence.

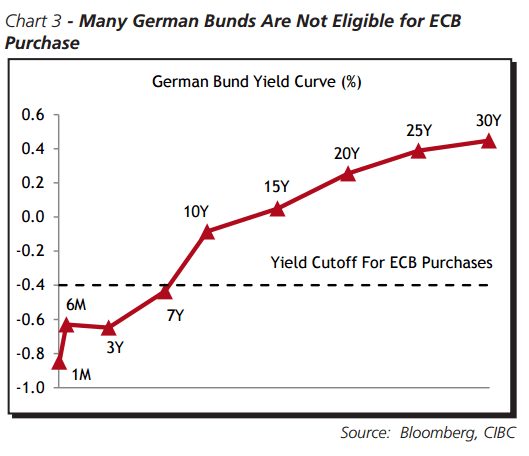

On the monetary policy front, the ECB is facing a shrinking supply of assets to buy as part of its QE program, especially of German Bunds of which the Bank cannot buy anything with a yield less than -0.40% (Chart 3). As a result, the Bank may need to alter the composition of its program to preserve its EUR80 bn monthly target. On top of all of this, the cloud of Brexit negotiations still looms large into autumn. The effects of QE modifications will likely be more apparent in yields than in the EUR.

However, when taken with a market that is still too complacent on the Fed, the influence of EU/US spreads should continue to weigh on the EUR. That will see the recent divergence between spreads and EURUSD correct as the single currency weakens in the months to come, though the current account surplus should mitigate some of the pain.

CIBC targets EUR/USD at 1.08 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.