EUR/USD has its correction, riding on the mixed Non-Farm Payrolls in the US. And what’s next for the world’s most popular currency pair? And how is GBP/USD behaving?

The team at Goldman Sachs sees a 5 wave squeeze and the wedge in pound/dollar as ending:

Here is their view, courtesy of eFXnews:

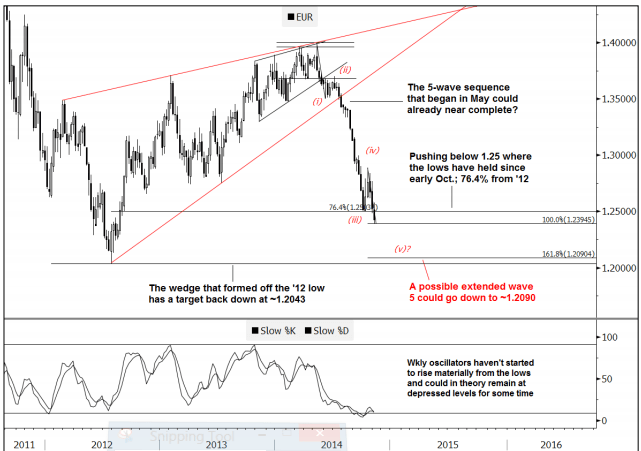

EUR/USD minimum target for wave 5 of 5 from May comes in at 1.2395; the low has been 1.2358, notes Goldman Sachs.

However, GS thinks that although it’s feasible that wave 5 could go as far as 1.2090 (which is 1.618 times wave 1), it is now more important than ever to watch very carefully for any signs of the market basing.

“Even still, the market is now within range of three previous cycle lows since ’08; 1.2331, 1.2490 and 1.2043. So ultimately it’s an area which requires a little bit of caution going forward,” GS argues.

“Once a full 5-wave sequence is in place, markets are prone to entering a corrective phase which might last a third of the time it took to decline. Whether its from here or from 1.20, once wave 5 is done, EURUSD could in theory enter ~1-2 months of range-bound/messy price action taking it side-ways possibly even higher,” GS projects.

In Cable, GS warns that there’s a risk that the drop since early-September is an ending wedge

“These types of structures tend to represent signs of overlapping/corrective behavior. A material squeeze could end up developing if the market were to break through the top of the pattern which currently comes in at 1.6082,” GS clarifies.

“In order to cancel out the positive implications of the pattern, would have to see a weekly close below 1.5829-1.5751. This area includes a number of previous highs and lows since Nov. ’12 and 61.8% of the Jul. ’13/Jul. ’14 rally,” GS argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.