The FX market is slow and as one client said in our chat room, it may not be a bad idea to take a day off as price action can be slow until tomorrow’s FOMC statement. Well, pairs are still in corrective phase from where we expect a break in favor of the USD.

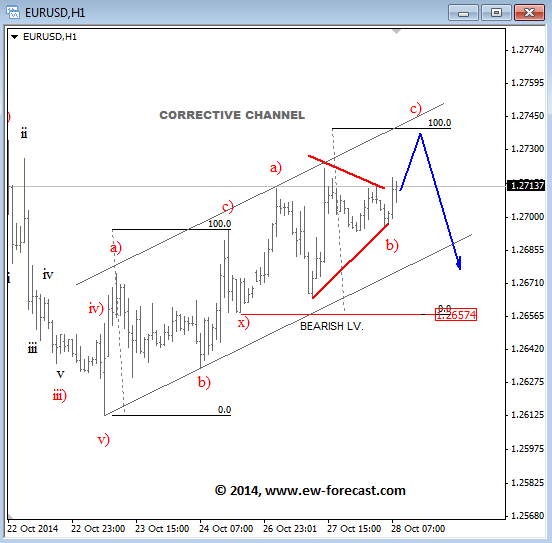

On EURUSD we see a slow and overlapping move higher within a trading channel which has the characteristics of a corrective price action. We are looking at a double zigzag with wave c) now underway to 1.2740 where bullish swings can be limited.

EURUSD 1h Elliott Wave Analysis

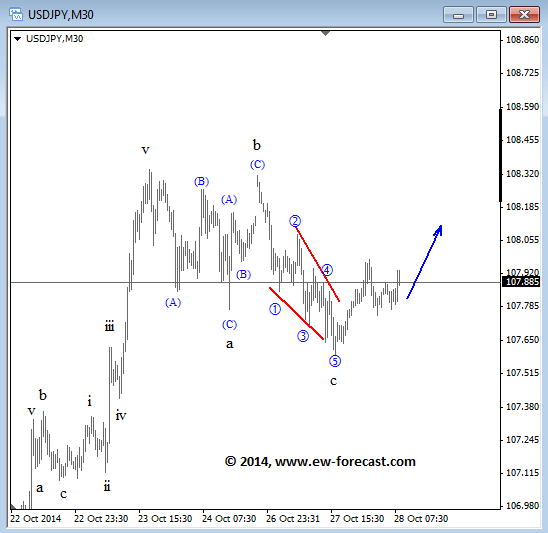

USD is also showing a bullish structure against the Japanese yen as decline from 108.30 unfolded only in three waves so far. In fact, there is an ending diagonal in wave c that occurs at the end of the move, so uptrend continuation may follow in sessions ahead. We expect a break above 108.30 in this week.

USDJPY 30min Elliott Wave Analysis