EUR/USD continues the downwards slide and is now consolidating under another support level. A week has passed since Spain opened the door for asking for help – a condition for ECB help. However, Spain is not in a hurry to actually take this extra step, and in the meantime, more voices are heard in Germany against ECB intervention. On this background, Spanish yields rise and the euro slides. Positive US figures add to the fall of the pair towards the weekend.

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

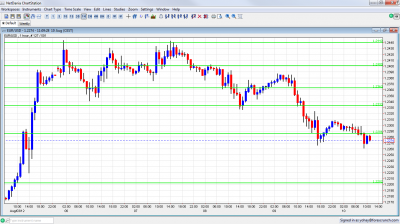

EUR/USD Technical

- Asian session: Euro/dollar managed to trade above the 1.2288 line before sliding lower in the European session..

- Current range: 1.22 to 1.2288.

Further levels in both directions:

- Below: 2288, 1.22, 1.2144, 1.2043, 1.20, 1.1876 and 1.17.

- Above: 1.288, 1.2330, 1.2360, 1.24, 1.2440, 1.2520, 1.2623, 1.2670, 1.2743 and 1.2814.

- 1.2330 is strong resistance.

- The break under 1.228 is still not confirmed. If it will be, the pair has a lot of room to fall.

Euro/Dollar lower as time passes by – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German Final CPI. Exp. +0.4%. Actual +0.4%.

- 6:45 French Industrial Production. Exp. +0.4%. Actual 0%.

- 12:30 US Import Prices. Exp. +0.1%.

- 18:00 US Federal Budget Balance. Exp. -$103 billion

EUR/USD Sentiment

- Pressure on ECB from both sides:: In its Monthly Bulletin, the ECB revised its forecast of Euro-zone growth in 2012 from -0.2% to -0.3%, This negative news will increase the pressure on ECB head Mario Draghi to take action, especially regarding Italian and Spanish borrowing costs. Draghi recently declared that bond yields are unacceptable, and that the ECB will explore ways to act in the coming weeks. Italy and Spain want help, but don’t want more conditions and hesitate before asking for help. In Germany, opposition is growing for ECB intervention from former Bundesbank figures, such as Otmar Issing. The reminder of bond buying by the Bundesbank in the 70s was seen as “blackmail” by the German orthodox bankers.

- Negotiations over Greek bailout – after the summer: The EU / ECB / IMF delegation left Athens and said they were making progress in their negotiations with the Greek government. Talks are not scheduled to resume until September, after Greece has a scheduled bond repayment to the ECB. It is unclear where it will get the money from. There is again growing talk in Europe of a Grexit, and the likelihood of this happening before the end of 2012 are rising. Meanwhile, Standard and Poor’s lowered its outlook for Greece from stable to negative, and warned that the country was likely to miss the targets set out in the bailout package, which would increase the possibility of a default. The head of the Eurogroup, Jean-Claude Juncker, said that he doesn’t foresee a Grexit “at least until the end of the autumn. See how to trade the Grexit with EUR/USD.

- Better signs from the US, : Talk about QE3 or no QE3 continues after, Boston Federal Reserve President Eric Rosengren declared that the Fed should implement QE3 in order to help the troubled US economy. In the meantime, encouraging signs were seen in the US: apart from the positive NFP, jobless claims remain low and the trade balance deficit fell to lows last seen at the beginning of 2011. Other market players, however, believe that the QE3 camp seems to miss a simple reality.

- German numbers alarm markets: Recent German economic data has been weak, with PMIs, industrial production and manufacturing orders all disappointing the markets. The markets are getting jittery, as a Germany in decline could spell disaster for the struggling Euro-zone and send the euro tumbling. Just to add oil to the fire, Moody’s recently reduced the outlook on Germany, the Netherlands and Luxembourg from stable to negative.

- Spanish regions complicate bailout picture: The euro-zone’s fourth largest economy is trying to focus the crisis on the banks, but its regions are also in deep trouble. No less than 6 regions may ask to tap into the national bailout fund. National sentiment is strongly felt in Catalonia, which banned a budget meeting. The regions are part of the complex picture. Currently, optimism from Draghi has pushed yields lower: 6.77% on the 10 year bonds. This is welcome news, as recent yields were above the dangerous 7% level.

- Debt woes, recession weigh on Italy: Like Spain, Italy is facing spiralling borrowing costs which are a serious threat to the economy. The area’s third largest economy raised money in the markets with a yield of 5.96%, higher than 5.82% seen last time. The economic picture in Italy is grim, as the country is carrying a debt-to-GDP ratio of 123%, and with another GDP decline, has officially been in recession for one full year. Meanwhile, Italian Prime Minister Mario Monti has warned that the disagreements among Euro-zone members are hampering an effective response to the debt crisis and threaten the stability of the EU. The rhetoric between the Italian PM and German officials over what steps to take to tackle the debt crisis seems to be heating up.