EUR/USD is now recovering from the big plunge caused by Mario Draghi. The ECB did announce plans for bond buying, but this depends on some committee work and more importantly on official aid requests. It’s important to note that these are big steps forward in European terms, but expectations (created by Draghi himself) were so high, that the result was awful for the euro and for bond yields. There isn’t too much time to digest Draghi’s words, as another big event looms: Non-Farm Payrolls, to close this exciting week. Who said August was a slow month?

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

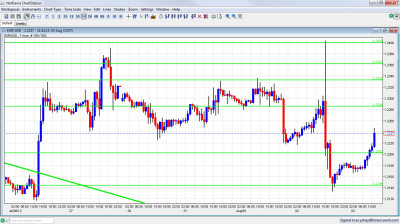

EUR/USD Technical

- Asian session: Euro/dollar traded in the low range above 1.2150 and began a move higher in the European session..

- Current range: 1.22 to 1.2288.

Further levels in both directions:

- Below: 1.22, 1.2144, 1.2043, 1.20, 1.1876 and 1.17.

- Above: 1.2288, 1.2330, 1.2360, 1.24, 1.2440, 1.2520 and 1.2623.

- 1.2330 remains the strong line of resistance before 1.24.

- 1.2150 was only temporarily breached and remains strong support.

Euro/Dollar recovering from Draghi – click on the graph to enlarge.

EUR/USD Fundamentals

- 8:00 Euro-zone Final Services PMI. Exp. 47.6. Actual 47.9 points.

- 9:00 Euro-zone retail sales. Exp. +0.1%. Actual +0.1%.

- 12:30 US Non-Farm Payrolls. Exp. +100K. See how to trade this event with USD/JPY.

- 12:30 US Unemployment rate. Exp. 8.2%.

- 12:30 US Average Hourly Earnings. Exp. +0.2%.

- 14:00 US ISM Non-Manufacturing PMI. Exp. 52.1 points, This will also have a strong impact on markets.

EUR/USD Sentiment

- Draghi doesn’t deliver: After Draghi said he will do “everything” to save the euro, markets expected much more action and not so many words, especially regarding bond buys. Draghi declared that bond yields are unacceptable, hurt the transmission of monetary policy and that the ECB will explore ways to act in the coming weeks. These bond buys would be limited to the short end of the curve, but could be unsterilized – full QE. This is a significant move forward. Opposition came only from Germany, and not from other northern countries. The move seemed like some kind of compromise with Germany. Apart from the exploration, the actions also depend on a formal aid request. Spain and Italy refuse to do so, at the moment. Perhaps Draghi expected Spain to act.

- Non-Farm Payrolls – some elevated expectations: The positive ADP report and the upbeat jobless claims during July provide hope for a better job gain for July, after the US had mediocre job gains beforehand. A gain of 100K is expected. The general notion is that stronger gains will aid the dollar, as the QE3 play is still dominant.

- Fed stays on sidelines, again: The Federal Reserve opted to refrain from implementing fresh easing measures, despite troubling data from the US economy. The Fed took note that economic growth was stagnant in 2012, and reiterated that it stood ready to act if necessary. This is a repeat of what Bernanke said in the past, and the change of wording is subtle. Some participants see easing coming in December, while others see it very soon. The QE3 camp seems to miss a simple reality.

- German economy slowing down: If the euro still is a new Deutschmark, there are enough reasons to be worried. German Services and Manufacturing PMIs both came in below the market forecast, indicating weakness in those sectors of the economy. This was followed by an awful Business Climate release, as the indicator fell below the market estimate and hit a two-year low in the process. Retail Sales was also well below the market estimate. The markets are clearly getting nervous, as a Germany in decline could spell disaster for the struggling Euro-zone and send the euro tumbling. Just to add oil to the fire, Moody’s reduced the outlook on Germany, the Netherlands and Luxembourg from stable to negative.

- Spanish regions want in on the bailout: The euro-zone’s fourth largest economy is trying to focus the crisis on the banks, but also its regions are in deep trouble. No less than 6 regions may ask to tap into the national bailout fund. National sentiment is strongly felt in Catalonia, which banned a budget meeting. Yields are above 7%. The meeting between Spanish PM Rajoy and his Italian counterpart Monti didn’t bring any news.

- Grexit fears rise as Greece likely to miss bailout obligations: Fears of a Greek exit from the Euro-zone have again surfaced. Greece is already running into difficulty meeting its bailout obligations, and this could jeopardize the bailout funds. Germany continues to take a tough line with Greece, as German Vice Chancellor Philipp Roesler warned that Greece must adhere to austerity measures in order to receive bailout funds. Meanwhile, the members of the troika, are holding talks with the Greek government in an attempt to resolve the latest crisis. Greece announced new austerity measures, but will it be enough to convince the troika? The country has to pay over 3 billion euros to the ECB on August 20th, and it doesn’t have the money at the moment. Another round of talks is planned for Sunday.

- High yields and crushing debt weigh on Italy: Doubts about Draghi’s seriousness can be seen in his own country. The area’s third largest economy raised money in the markets with a yield of 5.96%, higher than 5.82% seen last time. The specter of early elections in which the anti-euro sentiment will gain traction also weighs on Italy, that now has a debt-to-GDP ratio of 123%, and a contracting GDP.