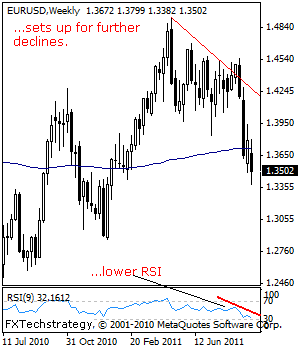

EURUSD: Drops Below Key Supports, Bearish Into The New Week – Technical Analysis

EURUSD: Having wiped out its previous week gains and closed below its key supports at the 1.3835 level, its Sept 09’2011 low and the 1.3623 levels, its July 12’2011 low to end week lower, EUR is entering the new week on a bearish note.

This suggests a follow through lower is likely to occur towards the 1.3427 level, its Feb’2011 low where violation will see the pair weakening further towards the 1.3382 level, its Sept 22’2011 low.

Guest post by www.fxtechstrategy.com

Price hesitation may occur here and turn the pair back up but if that fails to materialize, its psycho level seen at the 1.3300 level will be targeted ahead of the 1.3245 level, its Jan 17’2011 low. Its weekly RSI is bearish and pointing lower suggesting further weakness.

Alternatively, the 1.3799 level, its Sept’2011 high comes in as the next upside target with a breach of there setting the stage for more gains towards the 1.3835 level and next the 1.3936 level, its Sept 09’2011 high.

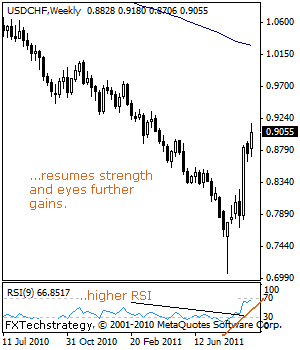

USDCHF: Reverses Losses, Upside Risk Builds On The 0.9340 Level

USDCHF: The pair closed the week strongly higher wiping its previous week losses and opening the door for further gains.

This development will leave the pair targeting the 0.9292 level where a break will aim at the 0.9340 level, its April 01’2011 high and possibly higher towards the 0.9400 level.

Alternatively, support stands the 0.9013 level with a breach turning attention to the 0.8929 level. A reversal of roles as support is expected at this level but if that fails its Sept 15’2011 low at 0.8647 level will be aimed at.

Below here will pave the way for a move further lower towards the 0.8574 level. Further down, support comes in at its Sept 08’2011 low at 0.8532.