EUR/USD is never a one way street and looks even more complicated now.

Is it a bounce or a bust? Two banks weigh in:

Here is their view, courtesy of eFXnews:

The technical FX strategy teams at Credit Suisse and JP Morgan provide their insights on EUR/USD technical setup and trading strategies in the near-term.

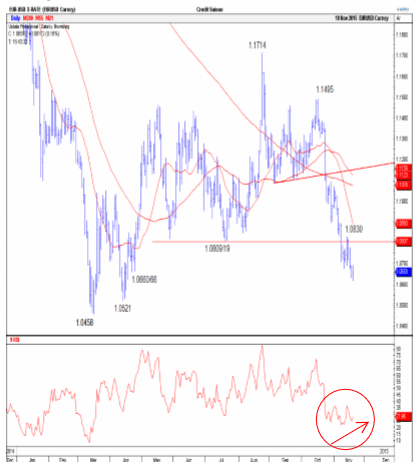

Credit Suisse: A small base warns of a near-term bounce, but we stay bearish for 1.0521, then 1.0458.

“EURUSD is showing some signs of near-term exhaustion, flagged by the RSI momentum divergence, which has failed to confirm the move to a new cycle low, and a minor intraday base has been completed above 1.0690. This leaves prices vulnerable to a near-term squeeze higher. However, any strength would be seen as corrective and we ideally look for the 1.0830 price high to continue to cap,” CS advises.

“Support shows at 1.0692/90 initially, then 1.0672, below which should see a move back to the 1.0617 recent low, ahead of 1.0521 and then the 1.0458 low for the year. Resistance moves to the 13-day average and price resistance at 1.0774/78, and we look for strength to ideally fail here,” CS adds.

CS is short EUR/USD from around 1.0770, with a stop at 1.0834, and a target at 1.0500.

JP Morgan: A temporary bounce to 1.0953 remains possible

“While the big picture remains negative we acknowledge the fact that the market is still trading within the decisive support zone between 1.0757 (int. 76.4 %) and 1.0596 (using a 1.5 % filter), leaving the door for a bounce open,” JPM argues.

“The latter could extend to 1.0953 (int. 38.2 %) which can be seen as the decisive T-junction where a 4th wave top would form in case the downtrend towards 1.0485/62 (wave 3 projection/int. 76.4 %) would still be intact. A break below 1.0596 would on the other hand challenge 1.0485/62 straight away before 1.0072 (76.4 %) would be in focus,” JPM adds.

JPM is currently flat on EUR/USD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.