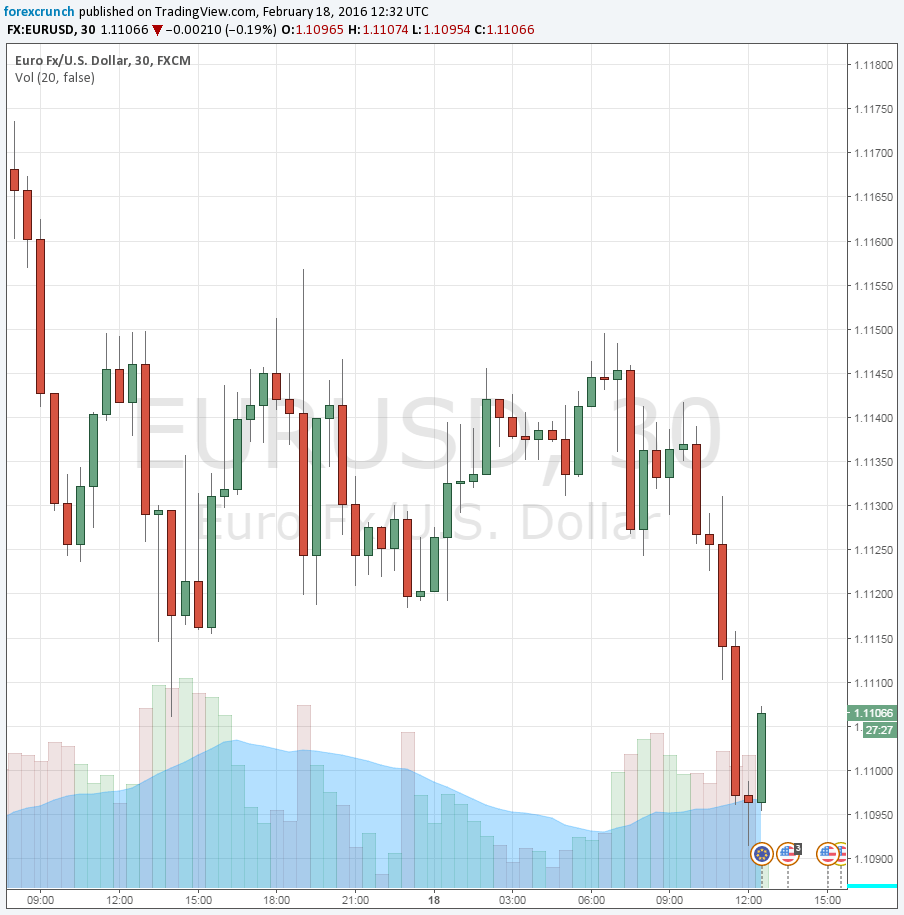

The publication of the meeting minutes by the European Central Bank triggered a small bounce in EUR/USD: from the lows of 1.1091 to 1.1109, but the pair still struggles to hold on to 1.11. Update: this doesn’t last too long and EUR/USD resumes its falls, reaching the 1.1083 low. Support awaits at 1.1070.

Basically, the document appears to be a repeat of the dovish words seen in the meeting.

The minutes show a debate regarding the message: on one hand a determination to act, but on the other hand a desire not to show any panic about inflation.

These are the minutes from the January meeting in which Draghi talked about further downside risks and vowed action in the March meeting. The minutes allow us to see the level of support. His German counterpart Jens Weidmann provided his support to the program.

Earlier, EUR/USD dropped under the 1.11 level as oil prices continued climbing and the mood remained positive. The euro remains a safe haven currency and ignores many pieces of data. The trade balance figure came out at a high rate, basically within expectations.

Yesterday’s FOMC meeting minutes showed caution and a bit of confusion regarding market activity: the Fed is worried about moves in markets but doesn’t understand why it’s going on when the economic activity looks OK.