EUR/USD lost the 1.0915 level, but is still holding above the May low of 1.0820. What does this mean?

Here are views from three banks:

Here is their view, courtesy of eFXnews:

As EUR/USD is drifting lower, technical strategy teams at Nomura, Barclays Capital, and SocGen provide their views on whether this move constitutes a breakout or still part of a broader range.

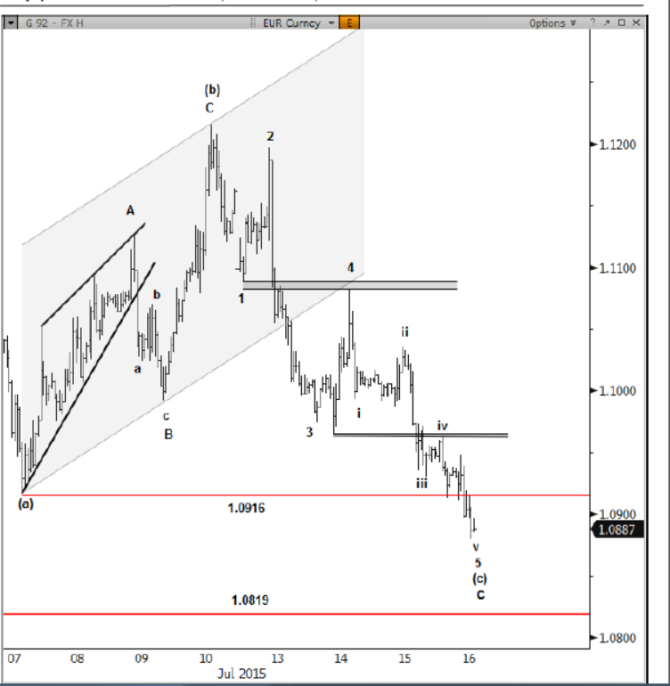

Nomura: Euro sold off to and broke 1.0916 support and that leaves a vacuum of support to 1.0819. The reason we are not pushing a more bearish case is twofold: first, the move from 1.1436 looks like an Elliott correction not an impulse and second, momentum is still constructive.

From an Elliott perspective, the decline from 1.1216 is a 5-wave decline that is nearing completion. We favor that this is wave-(c) of a larger 3-wave correction from 1.1436; holding above 1.0819 is critical to this count. Key upside resistance to better is 1.0916 followed by 1.0966 and 1.1083.

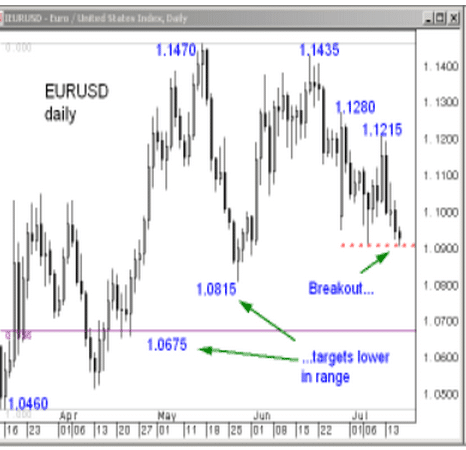

Barclays: The break below our initial downside targets near 1.0915 endorses our bearish view.

We are now looking for a move towards the 1.0815 range lows. Our greater targets are towards the 1.0460 year-to-date lows.

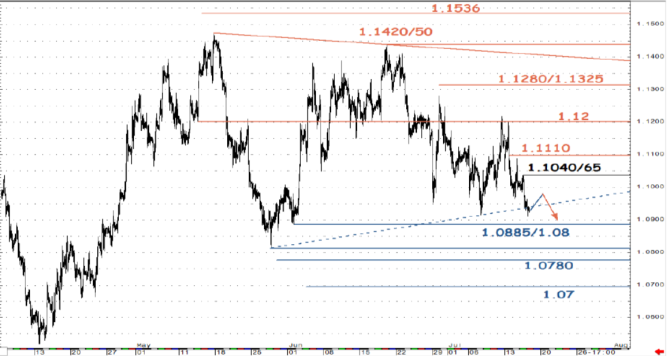

SocGen: EUR/USD is piercing below an upward trend and earlier highlighted intermittent support (1.0950). Daily RSI too is breaching a support.

However the broader consolidation zone still persists and 1.0885/1.08 will decide if the revisit of multi decadal channel at 1.05/1.04 happens.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.