EUR/USD fell off the 1.10 level after long and frustrating period of range trading. There may be more to come:

Here is their view, courtesy of eFXnews:

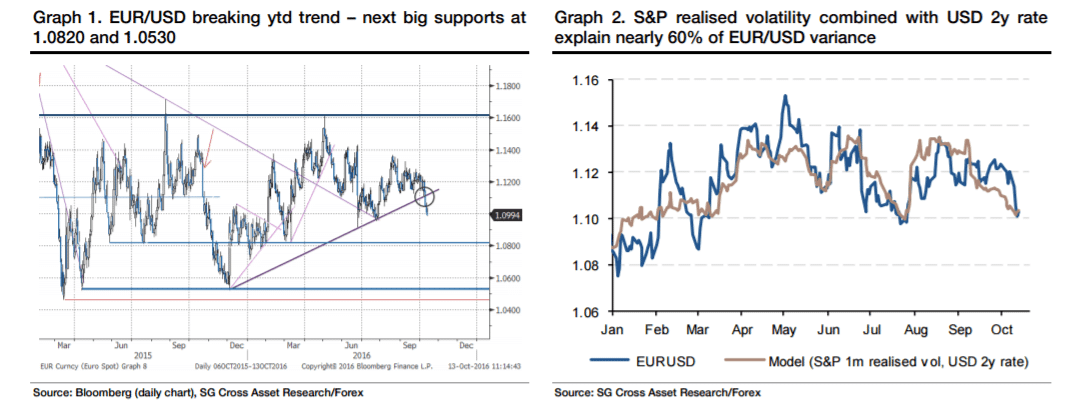

FX markets are seeing cracks. As we highlighted last week, the USD/JPY, GBP/USD and gold experienced significant breaks on 3-4 October. The EUR/USD (and USD/CHF) break on the downside happened later, the move taking place this week on 11 October, confirming the dollar index’s upward break the day before. Within its wide 1.05-1.16 range, EUR/USD had been diligently following a bullish trend since last December, but this is no longer the case, as it pierced the line below 1.1130 (Graph 1). As we write, themarket eyes the supports at 1.0820 and 1.0530.

The main theme is that a sustained wave a dollar strength is related to hawkish vibes from the Fed. The euro move happened just ahead of the FOMC minutes, which revealed that the case for a September hike was a “close call”, and our economists still view that the Fed is on track for moving in December. Interestingly, the euro bullish trend started exactly when the Fed increased rates last year. The board prepared the market for the tightening after summer 2015, and EUR/USD collapsed from 1.15 to 1.05. It reached its low point about two weeks before the first hike in mid-December 2015, when the ECB delivered an unconvincing package (the market hoped for more QE) triggering the bounce of early December. The Fed hike was already fully priced in, and the market subsequently unwound its dollar longs ahead of the meeting. We are now two months ahead of the December 2016 meeting, and there is still a decent 30% probability that the Fed will stay on hold, while the hike-implied probability has not been shaken by the minutes. There is still uncertainty about the Fed timing, which could easily fuel the ongoing leg of dollar appreciation.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The analysis suggests EUR/USD bearish option trades ahead of the December Fed. As the market will become increasingly worried about the next hike, the S&P should be more vulnerable and more turbulent (as per the negative correlation between stocks and their volatility). UST yields have a strong negative correlation with US equities, which implies higher S&P volatility. According to our model, this leads to a lower EUR/USD.

Selling the bottom of the range: Instead of targeting the exact level where the EUR/USD will trade in two months in a bearish scenario, we trade a sub-range, namely the portion of the full range below 1.08.

This can be implanted by buying a 2m Digital European put with a strike at 1.0750 and KO at 1.0450.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.