Euro dollar finally ended its consolidation and dropped sharply on fresh worries about a downgrade, the state of European banks and end-of-year flows. The pair is close to the year-to-date low. Will it set a new one in the last moment? Today we have quite a few US figures and another Italian bond auction.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

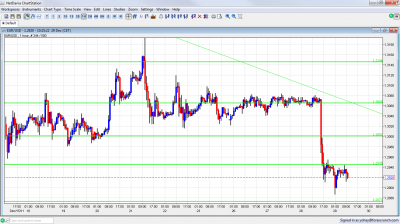

EUR/USD Technicals

- Asian session: Active session after the crash saw another drop lower, that stopped at 1.2886.

- Current range: 1.2873 – 1.2945.

- Further levels in both directions: Below 1.2873 , 1.2720, 1.2650 and 1.2580.

- Above: 1.2945, 1.30, .13060, 1.3145, 1.3212, 1.3280, 1.3380

- 1.2945 now switches to strong resistance, and the next big one is 1.3060.

- The year to date low of 1.2873 is very close. If this line is lost, it’s a free fall from there.

Euro/Dollar remains range bound around the pivotal line- click on the graph to enlarge.

EUR/USD Fundamentals

- During the day: German CPI (first release). Exp. +0.8%.

- 9:00 M3 Money Supply. Exp. +2.5%. Actual 2%.

- 9:00 Private Loans. Exp. +2.7%. Actual +1.7%.

- 10:10 Italian bond auction results.

- 13:30 US Unemployment Claims. Exp. 372K. See how to trade this event with EUR/USD.

- 14:45 Chicago PMI. Exp. 60.4 points.

- 15:00 US Pending Home Sales. Exp. +1.7%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Italy’s second test: The euro-zone’s third largest country had a 6 month bond auction worth 9 billion euros. The yield dropped from 6.5% to 3.25%. This impressive drop helped 10 year bonds: the yield dropped from around7% to 6.75% but it rose again afterwards and are above 7% once again. Italy will be tested once again.

- Oversold conditions ended: For a second week in a row, CFTC data showed that the number of net short contracts is at extreme levels. When everybody is short, there’s no one left to sell. This indeed changed and the euro fell sharply.

- Tensions rise around Iran: A recent law moving through the US congress aggravates Iran, which repeats its threat to close the Straights of Hormuz. These tensions send the price of oil up, and this weighs on the US dollar. Note that Mid-East violence could erupt in Syria, Lebanon and Israel rather than the Persian Gulf.

- Trade volume still low: All financial centers are now open, but many participants are still on vacation. Volume will likely stay low until January 3rd.

- US – Housing looks bad, employment looks good : After building approvals and housing starts exceeded expectations, existing home sales were low and saw significant downwards revisions. Also home prices haven’t reached the bottom, with a big fall. This sector is critical for US growth. Another drop in jobless claims provides hope and so does a rise in consumer confidence.

- France downgrade delayed Standard and Poor’s warned all euro-zone countries, apart from Greece, that their rating is endangered. France, Italy, Spain and others received a two-notch warning. The rating agency promised an answer within days and official talk from Paris begins preparing the public for a downgrade, saying “it’s not the end of the world” and similar comments. The publication of the report about euro-zone countries has been delayed to January. If France loses the AAA rating, so does the EFSF bailout fund. Moody’s and Fitch also added their warnings and could still act before year end.

- Greek talks stuck: Greece’s bondholders are struggling to reach an agreement about the “voluntary” debt restructuring. The parties aren’t getting close. And, the pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.

- The day after the euro: Some financial institutions are already working on contingency plans for the day after the euro. Symbols such as ITL (Italian Lira), ESP (Spanish Peseta) and GRD (Greek Drachma) are revived in computer software systems, but there is no confirmation about printing the old money. There was one rumor about the Irish mints working on printing the Irish punt (IEP), but this was never confirmed.