The ECB convenes this week after an extended period of silence from Draghi and amid falling inflation. Will the magician wallop the euro?

Here is their view, courtesy of eFXnews:

We think the EUR is likely to fall towards the end of the year and target a drop in EURUSD to 1.08.

The principal driver of our view is our expectation of a 25bp rate hike by the US Federal Reserve, which is not fully priced into markets. Also, the European Central Bank is likely to ease monetary policy further at its September meeting, extending the timeframe of its asset purchase programme by six months to September 2017. The combination of Fed tightening and ECB easing should stimulate financial outflows from the euro zone, weakening EURUSD; we continue to forecast a fall in the pair to 1.05 by the end of 2017.

The ECB’s July post-meeting statement was little changed from June’s. While the UK’s vote to leave the EU was described as an additional downside risk, ECB chief Mario Draghi said the ECB was sticking to its base-case forecasts of a continued economic recovery and a gradual rise in inflation. Our call for the next policy step remains an extension of the asset purchase programme probably by six months to September 2017. We think an announcement should come as soon as the next meeting on 8 September.

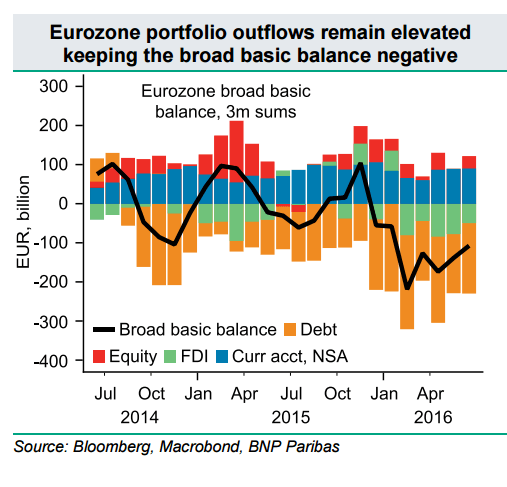

The eurozone’s large current account surplus means outflows on the financial account, in particular, portfolio flows, need to be robust and persistent for the EUR to continue to weaken. These outflows cannot be taken for granted and are likely to be sensitive to the broader risk environment. Furthermore, if expectations of EUR depreciation moderate, outflows are likely to become increasingly, currency hedged.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.