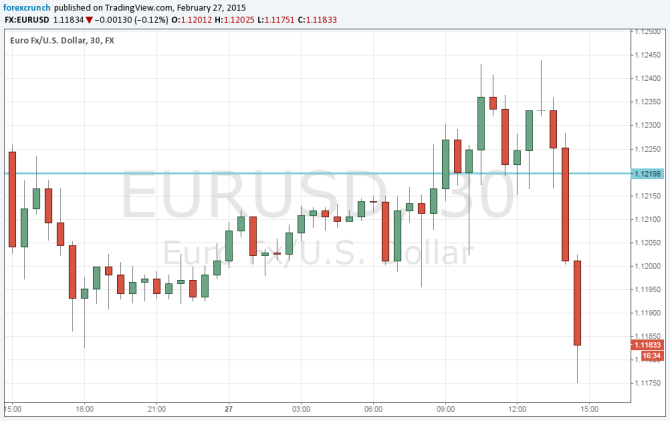

EUR/USD is trading at 1.1170. Fundamentally, the move originates from the US side, but also end-of-month factors are in play. The low so far is 1.1175 and the pair is bouncing, but below the 1.12 support line.

The euro is not alone in sliding against the greenback.

US GDP was revised to the downside, but slightly better than expected at 2.2%. Looking into the details, we can be encouraged by the fact that the fall was based in inventories.

But that’s only a minor beat and now we have much more recent data: the Chicago PMI badly disappoints with a plunge to 45.8 points, down from 59.4 and lower than 58.4 predicted. This is too bad to be true?

From the euro side, things are more upbeat: German inflation numbers beat expectations, and by quite a bit. So, the euro has nothing to do with the move.

Another factor is end-of-month flows, which cause choppy markets, and in this case, favor the dollar, for a reason we do not know at the moment.

Further support awaits at the multi-year low of 1.1098 seen on January 26 – just after the Greek elections. This is followed by 1.10 and 1.0860. On the topside, above 1.12 we have 1.1270.

Here is how it looks on the chart: