- The EUR/USD pair could bring great trading opportunities after escaping from the current range.

- Taking out the dynamic resistance represented by the upper median line (UML) could announce an upside reversal.

- Only a valid breakdown from the current range could bring new short opportunities.

The EUR/USD forecast sees the pair edge higher as the Dollar Index has turned to the downside. As you already know from my analysis, when the DXY drops, the EUR/USD currency pair grows. We have a strong negative correlation between these two, so you can use it in your forex trading at a good MT4 broker.

The price rallied though the US and the Eurozone data have come in mixed today. The German Gfk Consumer Climate was reported at 0.9 points even if the specialists expected to see the indicator at -0.4, while the German Import Price registered a 1.3% growth.

3 Free Forex Every Week – Full Technical Analysis

On the other hand, the US Durable Goods Orders dropped by only 0.4% versus a 1.1% drop expected, while the Core Durable Goods Orders rose by 0.4% as expected.

Unfortunately for the USD, the Goods Trade Balance was reported at -96.3B far below -88.2B estimates and compared to -87.6B in the previous reporting period, while the Prelim Wholesale Inventories registered a 1.1% growth versus 1.0% expected.

Don’t forget that the BOC is seen as a high-impact event, so it could have a significant impact on the DXY.

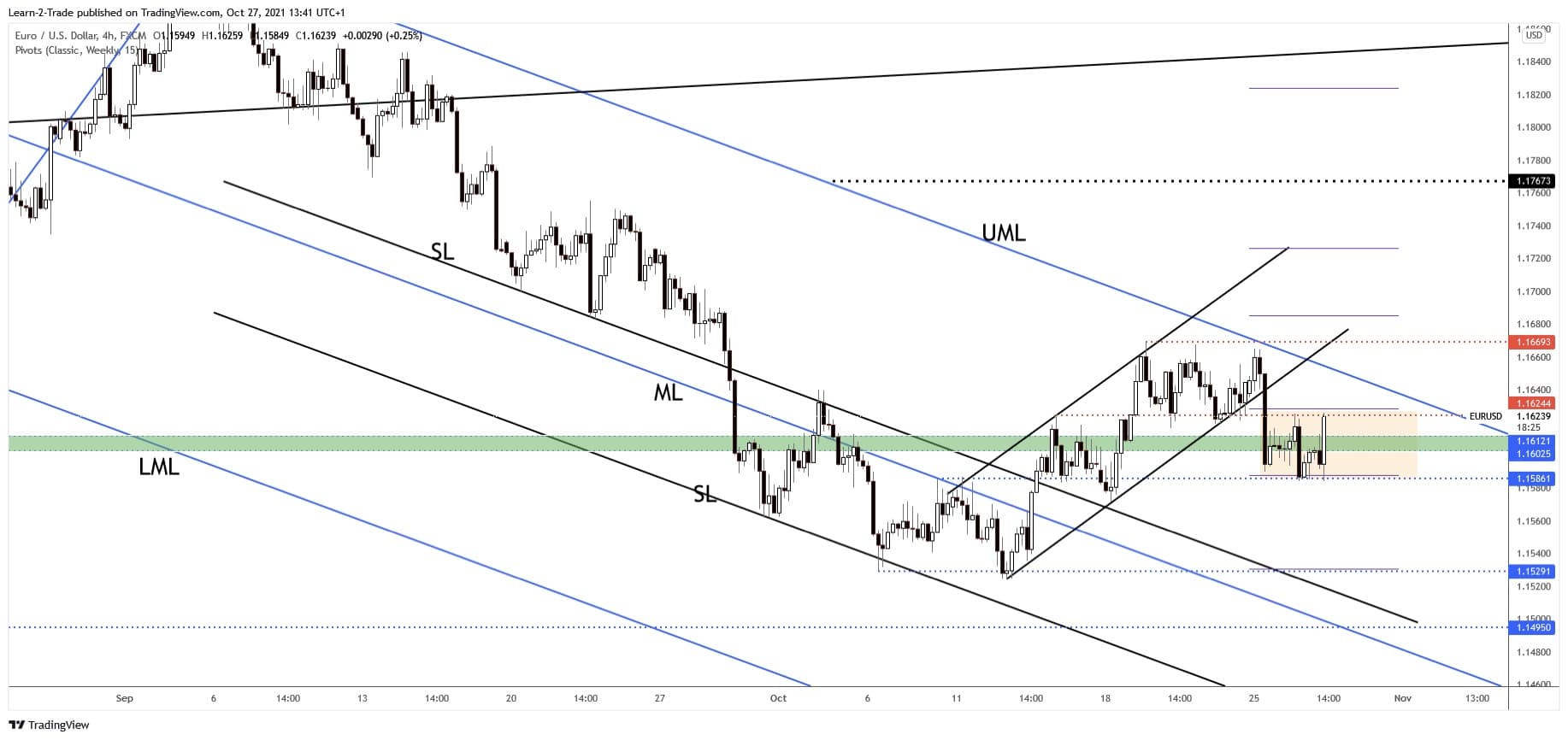

EUR/USD Forecast: Price Technical Analysis – Fresh Range

As you can see on the H4 chart, the EUR/USD is trapped within a range pattern between 1.1586 and 1.1624 levels. It has registered only false breakdown below the weekly S1 (1.1588) and under the 1.1586 downside obstacles.

Now it has reached the 1.1624 static resistance. It remains to see how it will react as the pressure remains high after failing to reach the descending pitchfork’s upper median line (UML). The current range could bring new trading opportunities. A valid breakout from this formation could bring a clear direction.

Jumping, closing, and stabilizing above the weekly pivot point (1.1628) could signal that the downside is over and that the EUR/USD pair could make an upside breakout above the upper median line (UML) as well.

This scenario could announce potential upside reversal. On the other hand, staying below 1.1624 and registering a downside breakout below 1.1586 could activate a deeper drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.