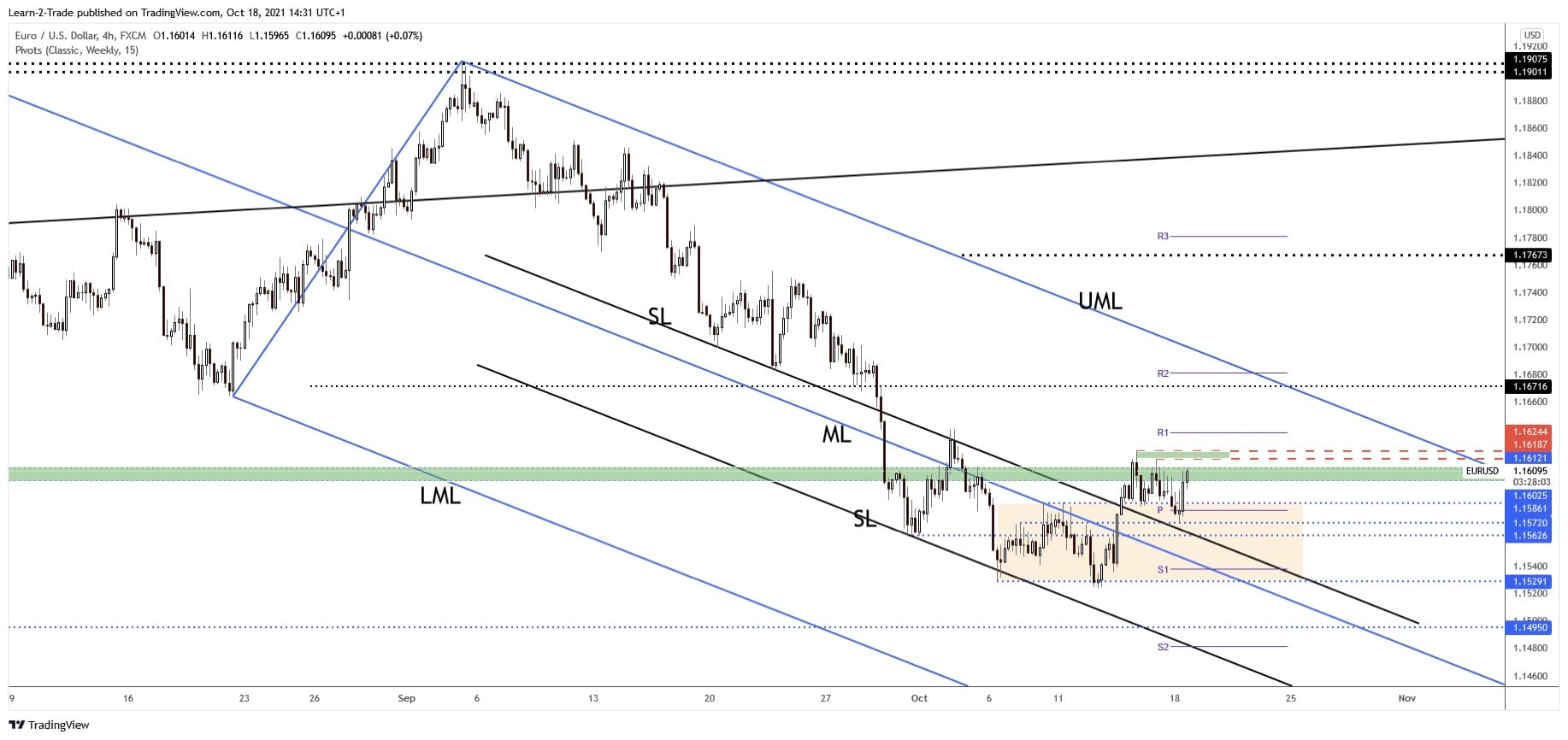

- The EUR/USD pair maintains a bullish bias despite the temporary retreat.

- A new higher high may activate an upside continuation towards the descending pitchfork’s upper median line (UML).

- Its failure to stabilize under the weekly pivot point signalled a potential growth towards the R1.

Our EUR/USD forecast sees the pair retreating after the last rally but the bias remains bullish. Technically, the correction could represent a continuation pattern. The Dollar Index is still bearish despite a temporary rebound. So, DXY’s deeper drop should force the pair to approach and reach new highs.

Technically, the EUR/USD pair continues to pressure a resistance zone, so, we’ll have to wait for the price to confirm a potential upwards movement.

3 Free Forex Every Week – Full Technical Analysis

Fundamentally, the USD received a hit from United States Industrial Production which dropped 1.3% in September even if the specialists expected a 0.3% growth.

In addition, the Capacity Utilization Rate was reported at 75.2% below 76.6% expected and versus 76.2% in August.

Tomorrow, the US is to release its Housing Starts and the Building Permits. The US data could bring more action to EUR/USD.

If you are looking for a new forex broker, check out our review of the top picks

Dollar Index Price Technical Analysis: Bearish Pressure!

The US Dollar Index is trading in the red at 93.97 level below 94.17 today’s high and under 94.09 weekly pivot. Its failure to stay above the ascending pitchfork’s median line (ml) signalled a potential correction.

DXY failed to reach and retest 93.72 static support, former resistance. Technically, it could still come back towards this level if it drops and closes below the inside sliding line (sl). It’s trapped between the median line (ml) and the sliding line (sl). Escaping from this channel could bring a fresh direction.

EUR/USD Forecast: Price Technical Analysis – Key Resistance Area!

The EUR/USD pair dropped a little after failing to stabilize above 1.1612 – 1.1602 resistance area. Now it has found support right below 1.1581 weekly pivot point, on the 1.1572 static support.

At the moment of writing, the pair continues to challenge the 1.1612 – 1.1602 resistance area. From the technical point of view, the EUR/USD pair was somehow expected to come back to test and retest the broken upside levels.

Jumping and stabilizing above 1.1612 and making a new higher high may activate further growth ahead. The descending pitchfork’s upper median line (UML) stands as a major upside target.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.