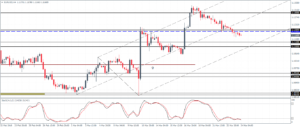

EURUSD Daily Analysis

EURUSD (1.11): EURUSD continues its declines for the fourth day, albeit price action has remained very tight. Having cleared the 1.120 support, EURUSD is likely to slip towards 1.113 – 1.1105 lower support before any attempts to correct the declines can be made. A close back above the 1.12 handle could keep EURUSD range bound, while below 1.1105, further declines could be seen sending the single currency towards 1.10 handle. The consolidation is likely to continue until the end of the trading week.

USDJPY Daily Analysis

USDJPY (112.80): USDJPY looks poised to the upside, but yesterday’s doji candlestick pattern calls for caution. A close above yesterday’s high at 112.907 on a daily basis will clear the way for further upside in prices. With USDJPY now trading above 112.0 handle, the bias shifts to the upside as long as the support holds. There is, of course, a hidden bearish divergence formed in prices right now which could see some downside pressure in USDJPY in the near term. Below 112.0, the previous support at 111.31 will be back in focus.

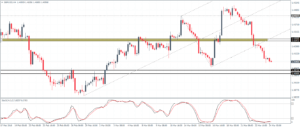

GBPUSD Daily Analysis

GBPUSD (1.40): GBPUSD closed below the 1.42 handle yesterday and marks a three-day strong decline following the doji pattern last Friday. Price action could see a possible pullback to the 1.426 – 1.4247 broken support to establish resistance ahead of further declines while support at 1.402 – 1.40 will be likely to hold the declines for now. But a failure below this lower support could send GBPUSD back to previous lows to 1.39. UK retail sales data will be the big catalyst early on followed by US data due later in the afternoon.

Gold Daily Analysis