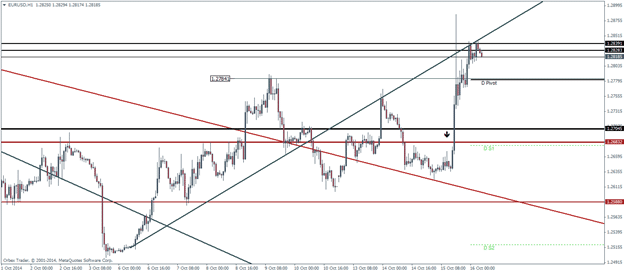

EURUSD Daily Pivots

| R3 | 1.3203 |

| R2 | 1.304 |

| R1 | 1.294 |

| Pivot | 1.2782 |

| S1 | 1.2678 |

| S2 | 1.2519 |

| S3 | 1.2415 |

EURUSD managed to reach the inverse head and shoulders pattern’s price objective of 1.2858, a previously established resistance level. With the Eurozone CPI due later today, the EURUSD could be volatile if the inflation reading comes in above or below estimates. Technically, support could be found near 1.2784 level which shows confluence with today’s daily pivot level for a potential move to the upside, breaking above the established resistance near 1.2858. To the downside, if the 1.2784 support level gives way, we could see a test back to 1.27. It must be mentioned that the current price action, even if declining towards 1.2784 is shaping out to be a bullish flag, although still in its early stages, which tilts the bias to the upside.

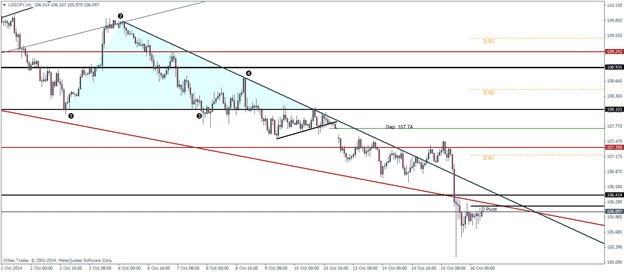

USDJPY Daily Pivots

| R3 | 109.51 |

| R2 | 108.5 |

| R1 | 107.21 |

| Pivot | 106.204 |

| S1 | 104.91 |

| S2 | 103.9 |

| S3 | 102.61 |

USDJPY broke down to make an intra-day low to 105.197 breaking below the descending triangle’s target of 106.41. The pair is currently consolidating and could likely rally towards testing the broken support at 106.41 for possible move to the downside towards 105.7

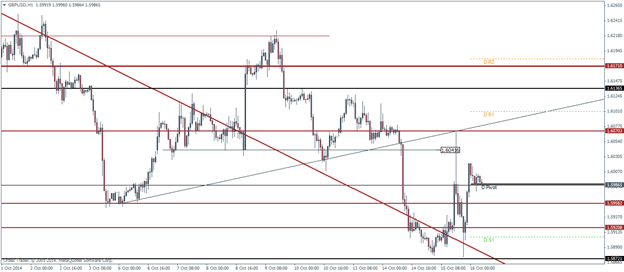

GBPUSD Daily Pivots

| R3 | 1.6295 |

| R2 | 1.6182 |

| R1 | 1.6101 |

| Pivot | 1.5988 |

| S1 | 1.5906 |

| S2 | 1.5793 |

| S3 | 1.5712 |

GBPUSD rallied back above the trend line and at the time of writing is currently forming a bullish flag pattern. Price reversed just a few pips away from the mentioned 1.58721 region. The bullish flag could likely see a rally towards the first daily resistance level above which lies the technical resistance at 1.60703. The key risk to the pair is the US weekly unemployment claims to be released during the US trading session.