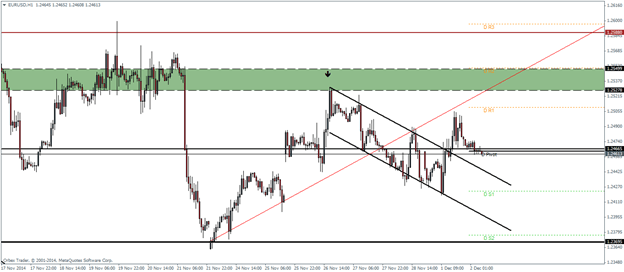

EURUSD Daily Pivots

| R3 | 1.2596 |

| R2 | 1.2551 |

| R1 | 1.2509 |

| Pivot | 1.2464 |

| S1 | 1.2422 |

| S2 | 1.2376 |

| S3 | 1.2335 |

The one hour charts for EURUSD shows a bullish flag pattern being formed with price having broken out of the flag recently and currently heading lower to retest the break out level. As long as prices stay above the daily support 1 level, the bullish flag could see an upside shift in the bias for EURUSD. The immediate resistance however comes from the 1.255 – 1.225 levels, which if cleared could see EURUSD head to 1.26 levels. However, if the resistance holds, we could see the bullish flag pattern failure with a decline back to 1.2369.

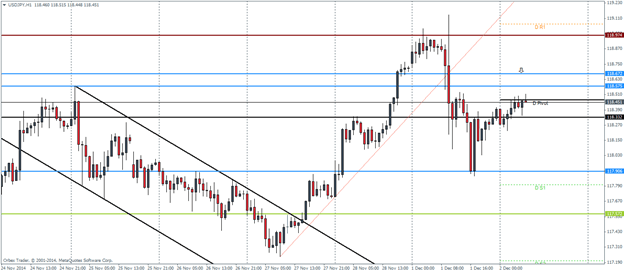

USDJPY Daily Pivots

| R3 | 120.332 |

| R2 | 119.734 |

| R1 | 119.066 |

| Pivot | 118.468 |

| S1 | 117.8 |

| S2 | 117.202 |

| S3 | 116.534 |

As noted in our yesterday’s analysis, USDJPY failed to break above the highs of 118.974 and saw the pair promptly head lower. The current price action could potentially see a retest between 118.67 and 118.575, which if holds to cap any rallies could see a further decline to yesterday’s low at 117.9 followed by 117.572.

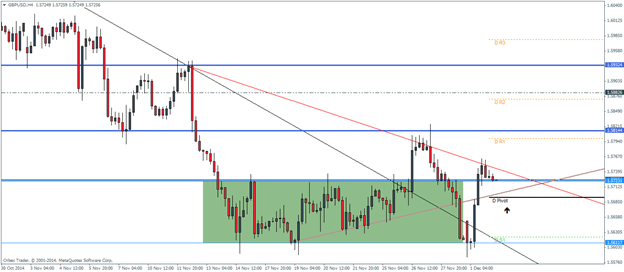

GBPUSD Daily Pivots

| R3 | 1.5978 |

| R2 | 1.587 |

| R1 | 1.58 |

| Pivot | 1.5692 |

| S1 | 1.5621 |

| S2 | 1.5513 |

| S3 | 1.5444 |

GBPUSD managed to push higher from the range lows with a break out and a current retest towards the daily pivot level. The daily pivot is also held up by the minor rising trend line support. If prices manage to hold at this level, we could potentially see a successful break out this time around with the potential to rally back towards 1.581 and possibly higher to 1.593.