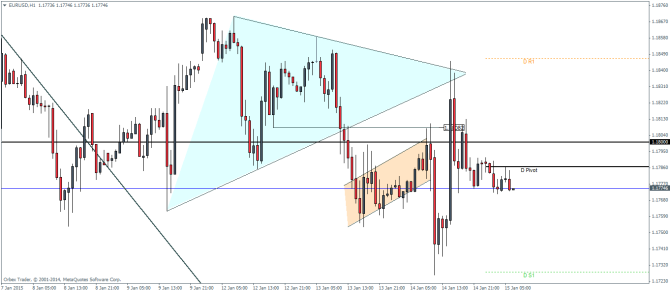

EURUSD Daily Pivots

| R3 | 1.1965 |

| R2 | 1.1905 |

| R1 | 1.1846 |

| Pivot | 1.1786 |

| S1 | 1.1728 |

| S2 | 1.1667 |

| S3 | 1.1609 |

EURUSD was marked by very choppy price action yesterday. But failure to stay above 1.18 levels is indicative that we could see the resumption of the bearish declines. We would need to see a close below 1.175 to be convinced of a continued move to the downside, targeting 1.17 and 1.168. If price action continues to be choppy, we could expect a possible rally back to test the 1.18 levels and eventually push higher towards 1.20

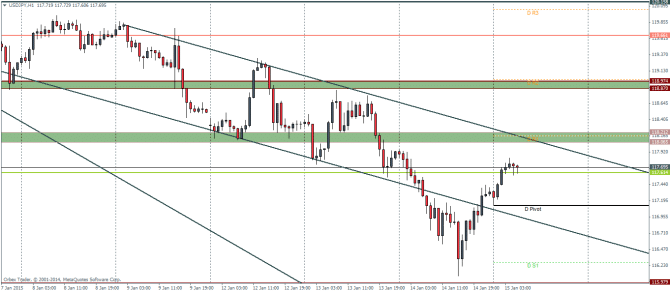

USDJPY Daily Pivots

| R3 | 120.049 |

| R2 | 119.004 |

| R1 | 118.166 |

| Pivot | 117.121 |

| S1 | 116.283 |

| S2 | 115.238 |

| S3 | 114.4 |

USDJPY managed to turn around after dipping to 116.076 levels upon breakdown from the price channel. Price however was quick to rebound from the lows to rally and close back into the price channel. The current rally could potentially be capped near the support/resistance level of 118.065, which should set the stage for a renewed decline with the potential to break lower testing 116 – 115.85 levels. On the other hand, a close above 118.212 will see a bullish rally that could reach towards 118.87 levels.

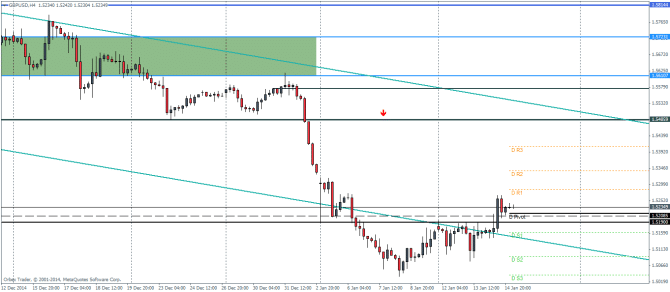

GBPUSD Daily Pivots

| R3 | 1.5407 |

| R2 | 1.5338 |

| R1 | 1.5284 |

| Pivot | 1.5215 |

| S1 | 1.5161 |

| S2 | 1.5092 |

| S3 | 1.5038 |

GBPUSD is gradually pushing higher after yesterday’s candle closed in the green. A retest to the daily pivot level at 1.5215 for support could establish higher gains for the Cable as we expect price to rally to fill the gap at 1.53344 and eventually head to test the broken support at 1.5486 for resistance A close below the daily pivot and an eventual decline back to the lower support line of the price channel will foresee a continuation of the bearish trend.