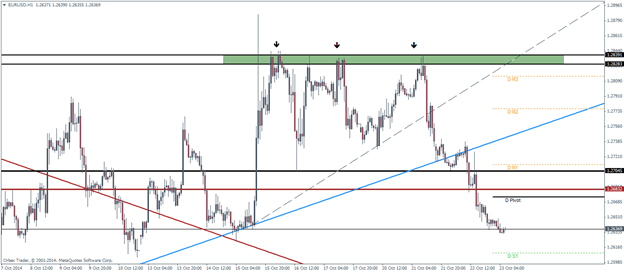

EURUSD Daily Pivots

| R3 | 1.2814 |

| R2 | 1.2776 |

| R1 | 1.2712 |

| Pivot | 1.2671 |

| S1 | 1.2609 |

| S2 | 1.2571 |

| S3 | 1.2507 |

From the daily charts, EURUSD confirmed its bearish engulfing candle with a lower close yesterday pointing to continued downside momentum. On the H1 charts, price broke through the secondary trend line to close below the main support levels between 1.27 and 1.268. A retest of this level is likely with the bias seemingly back to the downside in EURUSD. The next possible support levels come in at 1.2588 and 1.25, the level from where the pair had previously bounced off.

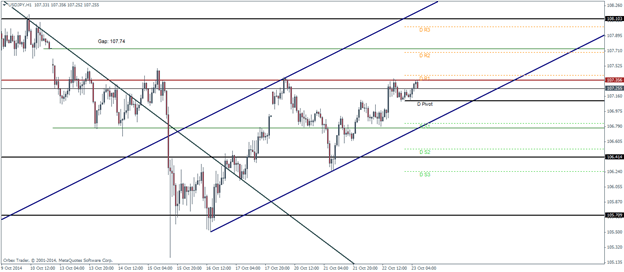

USDJPY Daily Pivots

| R3 | 108.005 |

| R2 | 107.692 |

| R1 | 107.417 |

| Pivot | 107.104 |

| S1 | 106.829 |

| S2 | 106.516 |

| S3 | 106.241 |

USDJPY confirmed its bullish pinbar few days ago after closing higher yesterday. On the H4 charts, we notice an inverted head and shoulders pattern which gives USDJPY a target to 108.85. On the H1 charts, price is currently struggling to break above the resistance level at 107.35, which is essential to see the pair push higher. There seems to be limited downside scope for USDJPY if the resistance at 107.35 fails to break. Possible declines could be capped near the daily support level 1 at 106.829 along with the lower channel line and a short term support level.

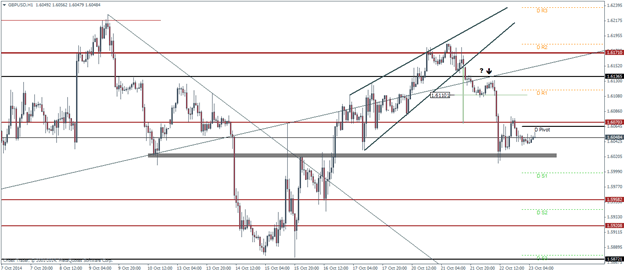

GBPUSD Daily Pivots

| R3 | 1.6236 |

| R2 | 1.6184 |

| R1 | 1.6117 |

| Pivot | 1.6064 |

| S1 | 1.5997 |

| S2 | 1.5944 |

| S3 | 1.5877 |

GBPUSD’s decline was stalled near the main support level at 1.6025 after breaking a short term support level above at 1.607. A retest of this level to confirm for resistance could see another attempt to break the lower support at 1.6025, which if it gives way could see the cable decline towards 1.5998. To the upside, the resistance at 1.607 could give way for further gains to 1.6136.