EURUSD Daily Analysis

EURUSD (1.13): EURUSD posted some major gains yesterday after nearly three days of moving in a small range. Price is back trading above the $1.13 – $1.135 handle and could potentially threaten the $1.140 region. The 4-hour chart continues to show the hidden divergence, and unless EURUSD manages to rise above 1.1421 and post a new high above 1.1464, the bias remains to the downside with 1.130 support as the initial focus.

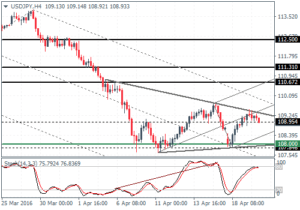

USDJPY Daily Analysis

USDJPY (108.9): Price action in USDJPY was fairly limited yesterday with the yen managing to hold its ground despite a weaker dollar with 108.95 coming in as a minor support/resistance, in play currently. The minor rising median line is currently showing USDJPY likely to move to the downside and the consolidation within the triangle pattern indicates some downside pressure. USDJPY could dip back to 108 support in the near term, and only a close below this level will indicate further downside.

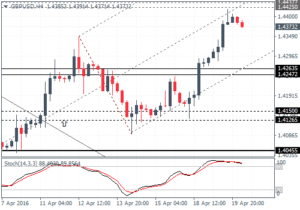

GBPUSD Daily Analysis

GBPUSD (1.43): GBPUSD has managed to rise towards 1.4425 level of resistance on the daily chart and price action has broken out to the upside, but not quite convincingly. Only a close above 1.4425 on the daily basis will confirm further upside. On the 4-hour chart, prices are currently retreating, and the current pullback could push GBPUSD lower to retest the support at 1.426 – 1.424 which could see a renewed momentum push GBPUSD back towards 1.4437 – 1.4425 to test for resistance. A close below 1.4263 – 1.4247 could, however, see GBPUSD weaken and dip towards 1.415 – 1.4126.

Gold Daily Analysis

XAUUSD (1252): Gold prices rallied yesterday and posted strong gains. However, the upside bias remains limited for now, although we could expect a test to 1260. With prices failing so far to post any fresh highs and gold currently trading above 1250 – 1243, we could expect potential downside in the precious metal for a test to 1230 – 1225 region.