EURUSD Daily Analysis

EURUSD (1.11): EURUSD has been bullish for the past three consecutive days with yesterday’s price action filling the gap from June 24 closing price at 1.1105. Price action is now seen challenging the 1.110 minor resistance level which previously acted as support around 30th May and in mid March. The 4-hour chart shows a hidden bearish divergence at the current price level which could signal a near term downside in the EURUSD. However, prices remain supported above 1.10 previous support that was formed. The upside bias to 1.112 remains open but expect EURUSD to remain range bound within 1.110 and 1.10 in the near term.

USDJPY Daily Analysis

USDJPY (102.7): USDJPY remains supported above 102 level, but the price action has been limited so far. On the 4-hour chart, there is a possibility that USDJPY is consolidating into an ascending triangle pattern with the resistance seen at 103. The near-term weakness could see USDJPY range between 103 and 102 levels with further upside likely on a break above 103 which could extend USDJPY’s gains to 104 resistance. To the downside, a break below 102 could send USDJPY back to the lower support zone near 101.26 and 101.0.

GBPUSD Daily Analysis

GBPUSD (1.339): GBPUSD has managed to close bullish yesterday establishing support at 1.32. On the 4-hour chart, prices started to decline following the shooting star pattern near 1.3488 resistant that was identified. GBPUSD remains range bound within the inside bars off the daily chart. To the downside, support at 1.32 – 1.312 is key while further upside can be expected only on a breakout above 1.348 – 1.341, in which case GBPUSD could extend its gains to 1.3677.

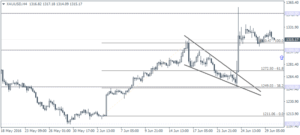

Gold Daily Analysis

XAUUSD (1315.17): Gold was trading bullish yesterday, but prices failed to breakout above the previous day’s highs. The ranging price action is expected to continue in the near term with 1300 support to the downside likely to be tested in the near term. On the 4 hour chart, gold prices have remained flat with another retest to 1310 support likely followed by the major support at 1300 pending for a retest.