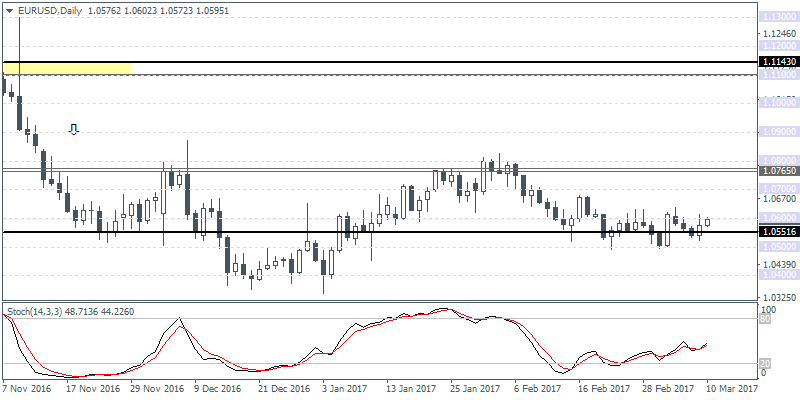

EURUSD intra-day analysis

EURUSD (1.0595): EURUSD managed to find support off the 1.0551 level, but the price is seen struggling near 1.0600 handle. A break out above this level is required for EURUSD to maintain the gains and potentially target 1.0700 resistance level. Price action remains range bound, and thus, there is a good chance that we could expect to see prices continue to consolidate near these levels for the time being. There is, however, a risk of a break down below 1.0551, which could potentially send EURUSD lower towards 1.0500 and 1.0400 support level.

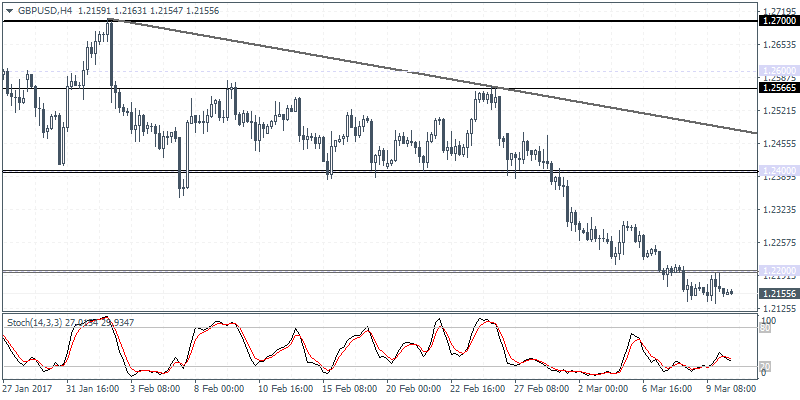

GBPUSD intra-day analysis

GBPUSD (1.2155): GBPUSD closed in a doji candlestick pattern on the daily session yesterday, but price action is expected to remain range bound within 1.2200 resistance level and the support level at 1.2100. Further gains or losses can be expected only on a break out from either of these two levels. Traders should, however, note that bullish divergence that is showing on the 4-hour chart, which when considered with the doji on the daily chart could signal some near-term upside risks. A breakout above 1.2200, could potentially turn the short-term trend in GBPUSD to bullish as prices could target 1.2400 resistance level.

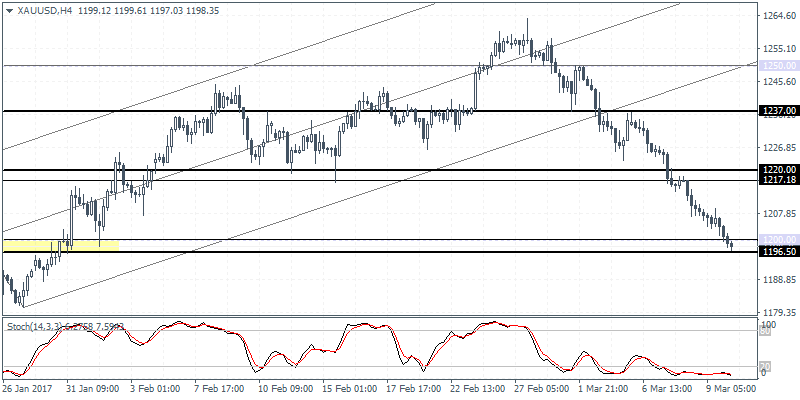

XAUUSD intra-day analysis

XAUUSD (1198.35): Gold prices are trading near the support level at 1200 as noted in the past few daily analysis reports. However, further declines can be ruled out as we expect gold prices to remain range bound within 1200 and 1220 levels. There is scope for an upside retracement above 1220, which could see gold test 1237 resistance level. On the daily chart, the current (higher) low in price has printed a lower low on the Stochastics, meaning that the hidden bullish divergence, with the price at support, could see some upside risks.