The crash of EUR/USD below 1.10, and at near 12 year lows at 1.0750 at the time of writing, is a “make the trend your friend” event for many forex traders.

However, it has much wider implications for global markets, as David Woo of Bank of America Merrill Lynch explains:

Here is their view, courtesy of eFXnews:

“In our view, the decline of EUR/USD below 1.10 may be less benign than it looks at first glance:

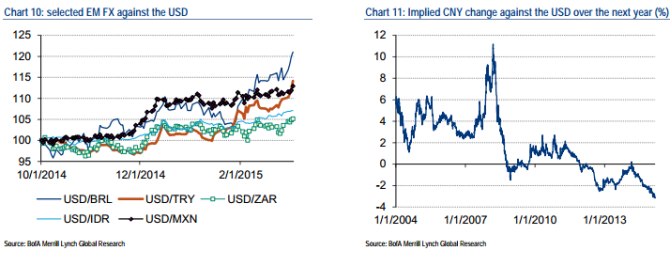

–Lower EUR/USD is exacerbating the exit from emerging markets. USD/TRY hit an all-time high last week (a risky cut, and USD/MXN is within striking distance of its all-time high reached briefly after the Lehman bankruptcy. Even USD/BRL has moved above 3 for the first time since 2004.

–Lower EUR/USD will likely put more pressure on China to devalue the CNY. As we have argued, a CNY devaluation, which would signal to us that China is joining the currency war, is the biggest tail-risk of 2015.

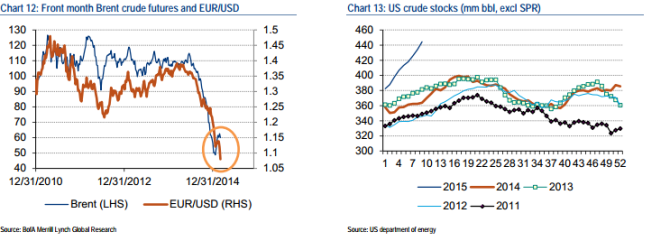

–Lower EUR/USD will likely place downward pressure on commodity prices,particularly oil prices. Our commodity team continues to think that the balance of risks for oil prices points to further downside given the elevated level of inventory globally.

–If the recent negative correlation between S&P 500 and USD/EUR were to hold,a lower EUR/USD could trigger a more generalized risk-off that would benefit deflationary assets including lower long-term Treasuries. Note that the recent back up in nominal yields has been driven by increased inflation breakevens.”

David Woo – BofA Merrill Lynch

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.