The fall of EUR/USD has been quite spectacular in the last days of 2014 and the early days of 2015 – falls which sent the pair to the lowest levels since 2006.

Is this all too soon? Did the market get ahead of itself? Kit Juckes of Societe Generale answers:

Here is their view, courtesy of eFXnews:

“The average move in EUR/USD over a calendar year since 1999 is 10 big figures (the range is from 2 figures in 2012, to the 21 figures we saw in 2003 as the euro recovered). EUR/USD ended 2014 at 1.21, and has moved 3 big figures in eight days. Furthermore, the EUR/USD direction for the first week of the year has been the same as the direction for the whole year in 13 of the 16 years since its inception, and the ones where the first week was in the opposite direction to the annual trend have all seen small moves over the year – the biggest was a 6 figure move in 2008 when the rally in H1 2008 was reversed as the world span out of control.

Such mundane statistics don’t mean much, except that it would be unusual for EUR/USD to have a positive year given this week’s move, and very unusual for it to be a substantial positive year. Our own year-end forecast is currently 1.14, at the lower end of the forecast distribution

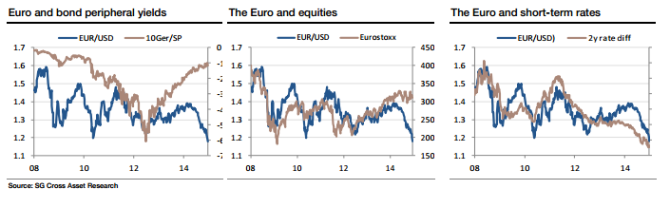

The only caveat to a bearish EUR view at the moment is that we may see a bounce after the ECB meeting and the Greek elections. The charts suggest that even for a committed EUR/USD bear, the market is a bit ahead of itself – and if we don’t see equity or peripheral bond market weakness by the month’s end, EUR/USD downside will be reliant on monetary policy divergence.”

Kit Juckes – Societe Generale

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.