Euro dollar kicked off the week with a gap lower, as the Greek haircut deal isn’t getting closer, to say the least. While the gap has already been closed, Greek worries come from various directions and weigh on the single currency. Without many indicators today, the news from the euro-zone will continue rocking the pair.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: Very active session, that saw a big Sunday gap lower, and then a strong recovery..

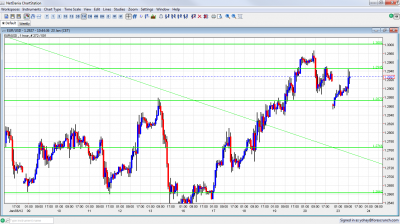

- Current range: 1.2873 to 1.2945.

- Further levels in both directions: Below 1.2873, 1.2760, 1.2660, 1.2623, 1.2580, 1.2520, 1.24, 1.2330 and 1.2144.

- Above: 1.2945, 1.30, .13060, 1.3145, 1.3212 and 1.3280.

- The break above 1.2945 didn’t last too long, and 1.30 was approached only from afar.

- 1.2873 switches into strong support.

Euro/Dollar in low ground- click on the graph to enlarge.

EUR/USD Fundamentals

- 15:00 Euro-zone Consumer Confidence. Exp. -20 points.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Greek haircut deal stuck: After a deal seemed very close on Friday, the banks and Greece seem far from a deal. Extra losses might be imposed on bondholders. Charles Dallara, which represents the banks, left Athens on Saturday, saying that their offer “reached the limits”. This might be part of the last minute negotiations.

- Greek mistrust: Fresh reports say that the EU and the IMF request a new report on debt sustainability, while a report on Germany’s Bild Zeitung says that these international creditors are “shaken” by the state of administration in the Hellenic Republic.

- Spain contracts but raises money: A report by the Bank of Spain says that the economy contracted by 0.3% in Q4. This was expected. In the meantime, the euro-zone’s fourth largest country enjoyed yet another great bond auction that yielded more money than expected, and at lower yields. In addition, the new government is moving forward to tackle trouble in the autonomous regions and banks.

- US unemployment drops: The number of jobless claims dropped to 352K, the lowest in almost 4 years. In addition, the employment component of the Philly Fed Index shined. Is America on the right path?

- Chinese continued weakness: The Chinese manufacturing sector continues contracting, according to a fresh report by HSBC. This cools the optimism seen by the strong GDP numbers over there. The Chinese front will be quiet next week, as the country celebrates the new year.

- Portugal deteriorates: The biggest victim of the multiple S&P downgrades is Portugal, which saw its yields leap. The chances of a default there are rising. The bond auction today will be closely watched. The downgrade of the bailout fund (EFSF) hasn’t hurt its bond auction. Also France, which got the historic downgrade, survived it quite well.

- ECB sees stabilization: The ECB bulletin and Mario Draghi expressed “tentative signs of stabilization” in the euro-zone.