Euro dollar is rising on very thin volume at the wake of 2012 just before all market participants return from their vacations. Outlooks for the euro-zone published over the weekend were quite grim as debt redemption looms over many countries and another month of contraction in manufacturing was confirmed.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

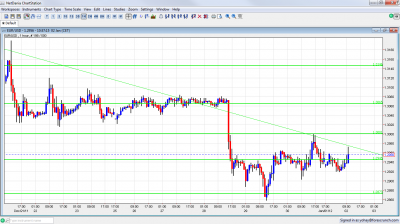

EUR/USD Technicals

- Asian session: Quiet session starts the year with the pair drifting along the 1.2945 line.

- Current range: 1.2945 – 1.30

- Further levels in both directions: Below 1.2945, 1.2873 , 1.2720, 1.2650 and 1.2580.

- Above: 1.30, .13060, 1.3145, 1.3212, 1.3280, 1.3380

- 1.2945 is now a pivotal line.

- The break under 1.2873 proved fake. The new 2011 low of 1.2858 was just a swing.

Euro/Dollar closing the year- click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 Euro-zone Final Manufacturing PMI. Exp. 46.9, actual 46.9, in contraction zone.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Volume low, about to rise: Almost all trading centers are closed today, in the extended New Year’s weekend. January 3rd and January 4th are when the markets will return to full speed.

- Gloomy expectations for 2012: Most media outlets posted grim outlooks for 2012 concerning the euro-zone as austerity measures push the economies into recession, this in turn triggers more austerity and the vicious circle continues. It doesn’t influence currencies so far, as volume is still very low.

- Iran tests missiles: Iran proceeded with testing missiles in the Persian Gulf. The threat of closing the Straights of Hormuz supports oil prices and this weighs on the US dollar. Note that Mid-East violence could erupt in Syria, Lebanon and Israel rather than the Persian Gulf.

- Italy’s worrying auction: The euro-zone’s third largest country couldn’t raise the maximum amount of money and paid high prices once again. Yields didn’t rise, but at these levels, recycling debt will place Italy in a debt trap.

- US awaiting NFP: The last figures for 2011 were OK. Jobless claims ticked up, but the moving average continues falling. Pending home sales leaped for a second month in a row, creating hopes for a bottom in the housing sector. The big event is Non-Farm Payrolls, the last publication for 2011 (apart from revisions). Expectations remain high for Friday’s release.

- Despite optimism, Greek talks stuck: Greece’s bondholders are struggling to reach an agreement about the “voluntary” debt restructuring. Greek politicians are optimistic, but there’s no evidence of progress in the PSI deal. The pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.