EUR/USD started the week in a quiet tone, settling in high range and consolidating the huge gains seen on Friday. Will the rally last? This is the big question facing everybody. The new month and new quarter are very busy. Before Draghi has his chance to complement the politicians actions with something of his own, fresh figures remind us that the economic situation isn’t as happy as the value of the euro. In the US, the first hints towards the NFP begin rolling out today.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

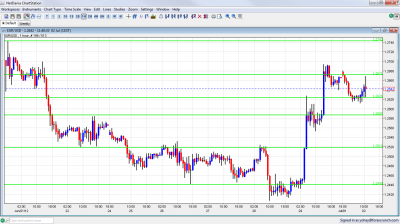

EUR/USD Technicals

- Asian session: Euro/dollar consolidated the gains, settling a in narrow and high range, a bit under Friday’s close.

- Current range: 1.2624 to 1.2670.

- Further levels in both directions:

- Below: 1.2624, 1.2520, 1.2440, 1.24, 1.2330, 1.2288, and 1.22.

- Above: 1.2670, 1.2760, 1.2814 and 1.2873, 1.29 and 1.2960.

- Yet again, the January 2012 low of 1.2624 proved to be strong in both directions. It now play a role as support.

- 1.2670 is just minor resistance towards the real thing – the post Greek elections high of 1.2748.

Euro/Dollar consolidates gains – click on the graph to enlarge.

EUR/USD Fundamentals

- 7:45 Italian Manufacturing PMI. Exp. 44.6. Actual 44.6 points.

- 8:00 Euro-zone Final Manufacturing PMI. Exp. 44.8. Actual 45.1 points.

- 9:00 Euro-zone unemployment rate. Exp. 11.1%. Actual 11.1%.

- 13:00 US Markit Final Manufacturing PMI. Exp. 53 points.

- 14:00 US ISM Manufacturing PMI. Exp. 52.1 points. First hint towards NFP. See how to trade it with USD/JPY.

- 14:00 US Construction Spending. Exp. +0.3%.

- 17:15 US FOMC member John Williams talks.

For more events and lines, see the Euro to dollar forecast

EUR/USD Sentiment

- EU Summit – the rally holds: In a late night effort, EU leaders agreed that the ESM will NOT have seniority over private bondholders. This will help in calming investors. Other than that, they decided on allowing the ESM bailout fund to recapitalize banks and buy bonds, but the statement is quite ambiguous. There are at least 5 holes in the EU Summit statement, so the rally could falter later on. Note that the Netherlands and Finland want to block ESM bond buying. There are quite a few hurdles.

- NFP Buildup: The manufacturing PMI is the first important figure in a very busy week. The US is expected to show more job gains, but not something that can inspire the whole world – the US is not a global locomotive, and neither is China, that saw another divergence between official and unofficial PMIs.

- German economy shows signs of weakness: The drop in retail sales joins earlier disappointments and shows that Germany is not immune. Last week saw disastrous German ZEW Economic Sentiment release and this week featured weak employment figures disappointed the markets. The number of unemployed people rose by seven thousand, exceeding the estimate of five thousand. The unemployment rate came in at 6.8%, above the 6.7% forecast.

- Lower Spanish yields: Spanish yields continue falling after Friday’s big move and this supports the euro.There are still some uncertainties and at least 8 holes in the aid package. More details about the bailout are expected on July 9th. The Spanish government is feeling the heat, and has just passed a new law limiting cash transactions.

- Dark Clouds Hovering over Italy: Italian PM Mario Monti has asked for help from Germany and the ECB as the situation worsens. The Euro-zone’s third largest economy is also suffering from a problematic banking system. This may explode later on. The economy isn’t doing much better, as GDP is squeezing fast. Italy cannot hide behind Spain for too long. If the economy continues to deteriorate, Italy could be the next EZ member to hop onto the bailout bandwagon.

- US Housing – a bright spot: Those still hoping for QE3 after the Fed decided not to introduce QE, but did announce that it would extend Operation Twist will find the improving housing sector to be a problem for their theory.Pending home sales, new home sales and building permits are on a rise.