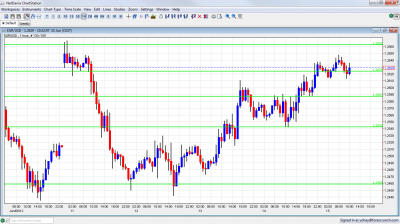

EUR/USD continued its gradual rise and is now battling strong resistance. There are reports about secret polls in Greece which point to a victory of the pro-bailout New Democracy party. This speculation could eventually turn into a short opportunity as results emerge early on Sunday. Yet again, US figures weren’t so good, but not enough for QE3. Also the ECB isn’t likely to move. How will the pair close the week? Here’s an update on technicals, fundamentals and what’s going on in the markets. EUR/USD Technicals

- Asian session: Euro USD continued playing with the 1.2624 line.

- Current range: 1.2587 to 1.2624.

- Further levels in both directions: Below: 1.2587, 1.2540, 1.2460, 1.24, 1.2330, 1.22, 1.2144, 1.20, 1.1876 and 1.17.

- Above: 1.2623, 1.2660, 1.2760, 1.2814 and 1.2873.

- The failure of the pair to hold above the all important line of 1.2624 is a worrying sign for euro bulls.

- 1.2540 is now stronger support after holding the pair.

Euro/Dollar higher on high hopes for Greece – click on the graph to enlarge. EUR/USD Fundamentals

- 6:50 ECB president Mario Draghi talks. He offered nothing new, not for the first time.

- 9:00 Euro-area Employment Change. Exp. -0.2%.

- 12:30 US Empire State Manufacturing Index. Exp. 13.6 points.

- 13:00 US TIC Long-Term Purchases. Exp. 45.3 billion.

- 13:15 US Industrial Production. Exp. +0.1%.

- 13:15 US Capacity Utilization Rate. Exp. 79.2%.

- 13:55 US Consumer Sentiment. Exp. 77.5 points. See how to trade this event with EUR/USD.

For more events and lines, see the Euro to dollar forecast EUR/USD Sentiment

- High hopes for the Greek elections: Polls are forbidden in the last two weeks before the elections. However, “secret polls” suggest that the pro-bailout New Democracy party is leading with a narrow margin. This is the only scenario in which the euro rallies, even if for a short time. See the 3 scenarios for the Greek elections. This is pushing the pair higher at the moment. A victory by anti-bailout SYRIZA or another indecisive result will send the euro plunging with a big weekend gap and could push Greece out of the euro-zone. See how to trade the Grexit with EUR/USD.

- Spanish yields flirt with 7% barrier: The markets continued bashing the Spanish bailout announcement which had at least 8 holes – including the eventual sum of money, the sources and impacts on other countries, including Greece. Spain is practically begging the ECB to help. So far, the powerful ECB has refused to get involved and provide help. Rating agencies add to trouble by downgrading Spain and its banks, which are intertwined too closely..

- Cyprus is the next line?: Spain is just the latest Euro-zone country to receive a bailout. Portugal, Ireland and Greece are all on bailout programs, and all three will have trouble getting back to the markets. Cyprus has a large exposure to Greek debt, and will likely be the next EZ member to join the bailout bandwagon.

- Italian yields remain high: The euro-zone’s third largest economy has a debt to GDP ratio that is much higher than that of Spain. Italy’s GDP declined by 0.8% in Q1, underlining concerns that Italy might need outside help. The markets may be focused on the crisis in Spain , but clearly Italy cannot hide behind Spain for too long. Apart from yields sitting above 6% in the secondary markets, also the recent Italian auctions were painful: Italy paid higher prices for recycling its funds.

- US recovery stalling?: The figures coming out of the US remain weak. This includes the recent jobless claims, retail sales and other indicators. However, the US still grew in Q1 and its economy probably continued growing in Q2. The US remains a safe haven, as low bond yields show.

- Little Likelihood of QE3: Fed Chairman Bernanke disappointed the markets with no hints about QE3. As always, he left the door open for any policy, and also mentioned a low risk of deflation. Nevertheless, his talk about a stabilizing housing market and diminishing returns for QE3, lowers the chances for action on June 20th, unless European troubles hit US shores in a horrible manner, but this is still to be seen.