EUR/USD is off from the highs that it reached following the FOMC, but still maintains higher ground and doesn’t seem to make signs it is returning to the low range anytime soon, even if European inflation is still a concern.

Here is a quick update on what’s moving the pair.

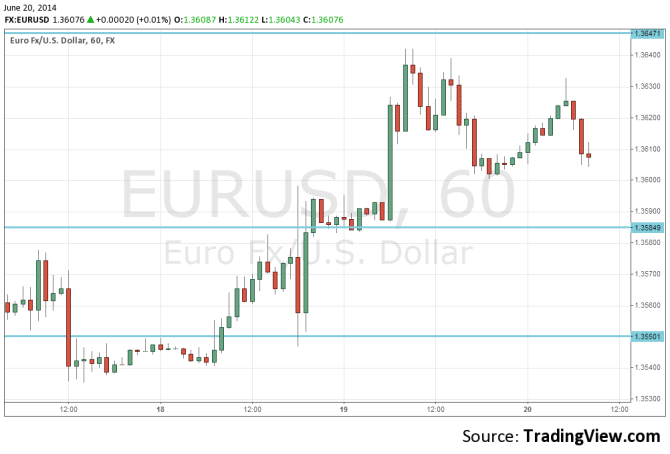

- EUR/USD climbed up to 1.3630 before sliding back down towards 1.36.

- Current range: 1.3585 to 1.3650.

Further levels in both directions:

- Below: 1.3585, 1.3550, 1.35, 1.3450, and 1.34

- Above: 1.3650, 1.3677, 1.37, 1.3740, 1.3785, 1.3830, 1.3865 and 1.3905.

- 1.3585 is an immediate support line, serving as a perfect separator of ranges.

- On the upside, 1.3650 worked perfectly well as resistance, and is now stronger.

EUR/USD Fundamentals

- 6:00 German PPI. Exp. +0.2%, actual -0.2%.

- 8:00 Euro-zon Current Account. Exp. 19.4 billion, actual 21.5 billion.

- 14:00 Euro-zone Consumer Confidence. Exp. -6 points.

*All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Yellen sees rising inflation as noisy: The Federal Reserve tapered QE for the 5th time to $35 billion/month as expected. The Fed also lowered growth forecasts, and this no surprise either. After the strong inflation numbers, some had expected a more hawkish tone from Yellen. Yet she described the data as noisy and left rate hike expectations in the far future. This eventually triggered a big USD sell off.

- US economic indicators remain OK: Both jobless claims and the Philly Fed figure came out slightly above expectations, showing a continued steady recovery for the US. Nevertheless, the data is far from having the power to tip policy in either direction.

- Not all is well in Germany: German ZEW Economic Sentiment weakened to 29.8 points, well off the estimate of 35.2 points. This was the worst reading we’ve seen since November 2012. Also the fresh PPI figure came short of expectations. As the locomotive of euro-zone growth, Germany is going nowhere fast.

- Eurozone inflation remains weak: So far, the euro did not lose enough ground even though various European interest rates have fallen after Draghi’s big announcement. This implies yet another month of low inflation in the euro-zone. We will get initial German numbers next week. If the euro remains strong and inflation continues falling, the ECB will have to be even more creative.

More: EURUSD Recovering Towards 1.3700 – Elliott Wave Analysis