Euro dollar continues losing ground and is dipping below another support line. The Eurogroup delayed the final decision about the second bailout to Greece for another week, after the bond swap is completed and a “final assessment” is made. The deadline for a default is getting closer, and it seems that Greece is pushed to the edge of the cliff. The credit event call was diverted for now, but it’s not the end of the story. How will this week end? EU Leaders are meeting in Brussels, but the Greek issue is officially off the agenda for today. We could still hear news of all sorts.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

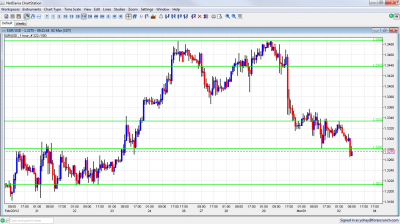

EUR/USD Technicals

- Asian session: Relaxed session after the Eurogroup sees tight range trading. The dip began in the European session.

- Current range: 1.3212 to 1.3280.

- Further levels in both directions: Below: 1.3212, 1.3145, 1.3060, 1.3060, 1.2945, 1.2873 and 1.2760.

- Above: 1.3280, 1.333, 1.3430, 1.3486, 1.3550, 1.3615, 1.37, 1.38 and 1.3950.

- 1.3280 provided good support so far. A confirmation of the break is awaited.

- 1.3333 is a tight spot.

Euro/Dollar dipping lower – click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Retail Sales. Exp. +0.5%. Actual -1.6%. Disappointing. Germany also saw good figures earlier in the week.

- 10:00 Euro-zone PPI. Exp. +0.6%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- Greek bailout delayed: Euro-zone finance ministers noted that Greece made a lot of progress. Nevertheless, they are waiting for the bond swap to finish and for a “final assessment”. The bond swap is planned to end on March 8th, with the final approval on March 9th or 12th. The March 20th deadline is getting too close. Here are 5 hurdles that could further delay or cancel the bailout.

- ISDA Doesn’t Call Default: The international body responsible for deciding if there was a default or not decided not to declare a credit event for now. They left the door open to more questions and a different decision, and noted the “evolving situation” in Greece.

- German ministers wants Greece to go: In a passive aggressive move, German finance minister Wolfgang Schäuble said that he will respect countries who want to leave. Greece doesn’t want to leave, but there’s a growing notion that it is pushed to declare bankruptcy. This joins the words of Hans-Peter Friedrich that said he would advise Greece to leave the euro-zone and said that Greece should be “made an offer it can’t refuse” to leave.

- IMF / Germany battle over contribution: The International Monetary Fund, which is massive funding from the US, is expected to provide a much smaller contribution to the second bailout. Together with the US, Japan, China and others, they want to see more willingness from Germany to contribute. In turn, Merkel has domestic troubles around this.

- Ben Bernanke acknowledged improving employment: The vast majority of Bernanke’s testimony was dovish, seeing many risks in the US. Nevertheless, he said that the improvement in employment surprised him. This was enough to boost the dollar, big time. Chances for QE3 in March 13th remain low..

- ECB LTRO II: Around 800 European banks grabbed nearly 530 billion euros. They are now better equipped for a crash and European leaders can feel safe and let go of Greece. The side effect was that banks accumulated sovereign bonds as collateral for the operation. Without LTRO 3 in sight, Portuguese bonds sold off immediately after LTRO 2. The ECB found itself intervening after two quiet weeks.

- German court hurdle: A German court might delay the euro-zone aid package by forcing a different procedure in parliament. Given past experience, this hurdle will likely be overcome.

- Plan B still possible: Despite the deal, things, such as the IMF contribution or more Greek misses, could still go wrong. There are reports about plans made in Germany and the US for a Greek bankruptcy on March 23rd, when Athens will raise a white flag and a bank holiday will be announced. Here are 5 more ominous signs that Greece is pushed to the corner.

- US Housing still sensitive: The sensitive housing sector has shown minor improvement via the existing home sales figure . Single family houses are still struggling, as well as foreclosures. The trend of falling jobless claims, at least in the 4 week moving average continued. The Case Schiller index becomes more important due to this sensitivity.