Euro dollar is sliding in range after the results of the Greek PSI were published. 85.8% was the participation rate before activating CACs. It will reach 95.7% afterwards. ISDA will discuss triggering a credit event due to the CACs at the same time that the Eurogroup will discuss how to proceed with Greece. Some hedge funds found a loophole in Greek bonds that may complicate the situation. The Eurogroup will discuss “how to proceed” with Greece. The all-important US Non-Farm Payrolls will be published at the same time. The week ends with a blast.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

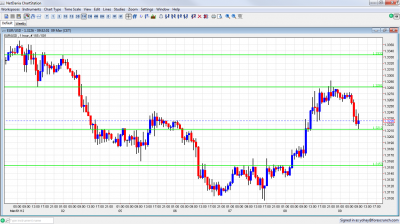

- Asian session: A quiet session saw the pair stick to the highs at the top of the range, before sliding to the bottom of it after the Greek PSI announcement.

- Current range: 1.3212 to 1.3280.

- Further levels in both directions: Below: 1.3212, 1.3150, 1.3050, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2620.

- Above: 1.3280, 1.333, 1.3430, 1.3486, 1.3550 and 1.3615.

- 1.3212 now switches to support.

- 1.3280 proved to be strong on the upside one again.

Euro/Dollar slides in high ground – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 Greek PSI announcement: 85.8% without CACs, 95.7% with them. This is relatively good, but the euro sold off.

- 7:00 German Trade Balance. Exp. 13.8 billion. Actual 14.2.

- 7:00 German Final CPI. Exp. +0.7%. Actual +0.7%.

- 7:45 French Industrial Production. Exp. +0.6%. Actual +0.3%.

- 12:30 Eurogroup teleconference to determine the next steps concerning Greece – meeting brought forward.

- 13:00 ISDA meeting to determine if a credit event has been triggered due to the use of CACs.

- 13:30 US Non-Farm Payrolls. Exp. 209K. See how to trade this event with EUR/USD.

- 13:30 US Unemployment Rate. Exp. 8.3%.

- 13:30 US Trade Balance. Exp. -48.9 billion.

- 13:30 US Average Hourly Earnings. Exp. +0.2%.

- 14:00 US Wholesale Inventories. Exp. +0.7%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- PSI – Good participation but CACs needed: The level of participation in the Greek Private Sector Involvement, or haircut, was relatively high. Nevertheless, it wasn’t high enough for reaching the goal of 95% for the second bailout. In order to reach this goal, Greece imposes “Collective Action Clauses” – which actually force the holdouts to receive the same haircuts like the others. Using CACs is involuntary, and if ISDA uses common sense, it will call a credit event, triggering Credit Default Swaps.

- Complication?: Government owned and guaranteed Hellenic Railways has an interesting provision that will allow hedge funds to get all their money. This story is still emerging. Even though the sum is comparatively low (400 million to 3 billion euros), this could still cause a delay.

- Don’t forget the prior actions: Even though Greece completed the PSI rather successfully, the EU still needs to provide a final green light. It depends on an assessment about Greece’s “prior actions”. German finance minister Schäuble said that the Eurogroup will decide what to do next. The decision could be postponed to next week.. Here are 5 hurdles that could further delay or cancel the bailout.

- German ministers wants Greece to go: In a passive aggressive move, German finance minister Wolfgang Schäuble said that he will respect countries who want to leave. Greece doesn’t want to leave, but there’s a growing notion that it is pushed to declare bankruptcy. This joins the words of Hans-Peter Friedrich that said he would advise Greece to leave the euro-zone and said that Greece should be “made an offer it can’t refuse” to leave.

- OK Employment Report expected: The employment component of the services PMI and the ADP report point to an OK Non-Farm Payrolls. This will likely be less shiny than last month, but will still show a gain of jobs. A disastrous report could trigger QE3 in the FOMC meeting next week.

- Draghi warns about inflation: The ECB left rates unchanged and made no policy changes. In the press conference, Draghi was very satisfied with the LTROs. He also warned about inflation, and said that the ECB has tools to fight it.

- Plan B still possible: Despite the deal, things, such as the IMF contribution or more Greek misses, could still go wrong. There are reports about plans made in Germany and the US for a Greek bankruptcy on March 23rd, when Athens will raise a white flag and a bank holiday will be announced. Here are 5 more ominous signs that Greece is pushed to the corner.

- Portugal will struggle to return to the markets: While Portugal is probably successful at implementing the program, it will find it hard to return to the markets, after Greece has defaulted and after the private sector got a haircut, while the official sector didn’t.