Euro dollar is leaning lower within a lower range, after more weak European data and before the highly anticipated Non-Farm Payrolls. The boost given to the pair by Draghi faded out. French, Greek and also local German elections are scheduled for the weekend and traders might clear positions ahead of all this risk. How will the pair end this turbulent week?

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: EUR/USD remained in narrow range under the 1.3165 line before dropping in the European session.

- Current range: 1.3110 to 1.3165.

- Further levels in both directions: Below: 1.3110, 1.3050, 1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623.

- Above: 1.3165, 1.3212, 1.33, 1.34, 1.3437, 1.3486, 1.3550 and 1.3615.

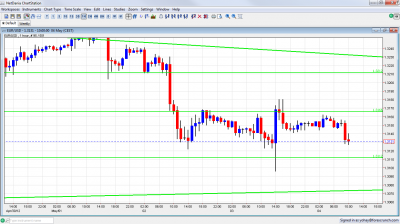

- The narrowing channel continues to be dominant – the pair fell sharply after hitting downtrend resistance. Will it bounce from uptrend support or fall?

- 1.3165 is only minor resistance before 1.3212.

- 1.3110 is the next level of support, and could be tested if the pair weakens further.

Euro/Dollar trading in narrow range – click on the graph to enlarge.

EUR/USD Fundamentals

- 8:00 Euro-zone Final Services PMI. Exp. 47.9. Actual 46.9. Another sign that the recession is deeper.

- 9:00 Euro-zone retail sales. Exp. +0.1%.

- 12:30 US Non-Farm Payrolls. Exp. 173K. See how to trade this important event with EUR/USD.

- 12:30 US Unemployment Rate. Exp. 8.2%.

- 12:30 US Average Hourly Earnings. Exp. +0.2%.

- 15:25 US FOMC member John Williams talks.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Worrying signs before Non-Farm Payrolls: Manufacturing PMI was upbeat, with an especially strong employment component. Also weekly jobless claims dropped back to the normal range at 365K. Nevertheless, the dominant sector, services, saw a weak PMI with a drop in the employment component and ADP’s private sector report showed a soft gain of 119K. Perhaps the weakness is already priced in. In any case, NFP is always important, and this time it is of high importance after the drop to +120K seen last month. In any case, PMIs point to growth and job gains are expected – just slower.

- French elections: Socialist leader Hollande is set to win the French presidency on Sunday’s election, with a small margin. He is not considered pro-market, and there are predictions that EUR/USD could eventually plummet to 1.20 if the Socialists form the next government. His election will mark a significant turn from austerity towards growth, perhaps a European Spring.

- Greek elections: Greece goes to its first elections after the bailouts and the political scene is messy, as politics shift from left-right to pro-austerity and anti-austerity. Here are 3 scenarios for the elections and their impact on the euro. In any case, coalition negotiations could last for a very long time.

- Local Elections in Germany: The northern state of Schleswig-Holstein hold elections on Sunday as well. This is a test for Angela Merkel’s CDU party, and could impact her policy. CDU is expected to lose ground.

- Draghi is Content: The president of the ECB sees the euro-zone economies still recovering in the second half of the year and passes the ball to the court of governments, not for the first time. A rate cut next month is still a remote option. His optimism pushed the euro higher, but not for a long time.

- Not so mild European recession: Also the services PMI disappointed with a significant downwards revision. Both PMIs clearly point to a serious recession, also in Q2. For many countries, the recession is not new at all: Spain is the latest member of a growing list of European economies now in recession, joining the ranks of a host of others, notably the UK, Netherlands, Belgium, Ireland, Greece, Portugal and Italy. Weak spending in France and lower confidence in Germany is sure to make matters worse.The deepening economic slowdown will likely have a negative impact on the euro, as we saw yesterday when the euro took a tumble on poor employment data. .

- QE3 chances dropping: Ben Bernanke didn’t rule out QE3, but as time passes by, this option seems quite unlikely, and even Bill Gross joined Primary Dealers and to back off his certainty that this move will come. A “hands off” policy of low interest rates for the foreseeable future is supportive for the greenback. Only a really horrible NFP will bring the QE3 back to the limelight.