Euro dollar is now recovering in lower range after the breakdown. The failed German bond auction has shown that Germany is not to the debt crisis, also in the bond market. Up to now, some of the money that fled out of the periphery found its way to Germany. When this money moves elsewhere, the euro has a lot of room for falls. It’s Thanksgiving in the US, so we have less figures and lower liquidity today. Will the pair fall even more?

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

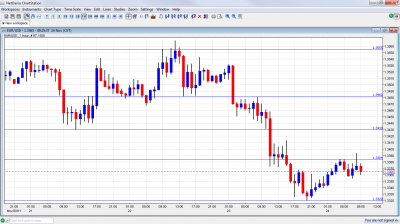

- Asian session: A quiet session saw the pair recover in range and mark 1.3380 as a top.

- Current range: 1.3320 – 1.3380.

Further levels in both directions: Below 1.3380, 1.3320, 1.3250, 1.3145. 1.30 and 1.2873.

- Above: 1.3380, 1.3420, 1.3480, 1.3550, 1.3650, 1.3725 and 1.38.

- After 1.3420 was lost it turns into resistance, with 1.3380 closely following it.

- The new low of 1.3320 is only minor support before 1.3250.

Euro/Dollar falls to lower end- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Final GDP. Exp. +0.5%. Actual +0.5%.

- 9:00 German Ifo Business Climate. Exp. 105.3 points. See how to trade this event with EUR/USD.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Wolves Closed in on Germany: The bond rout reached the core of the core. Germany managed to fill only two thirds of a planned 10 year bond auction. This sent the pair below support. Now that Germany isn’t immune, will the ECB finally be authorized to act massively in the bond markets? QE seems closer than ever. German yields continue higher once again, reaching 2.21%. The benchmark is broken. Also Japanese investors shift from German bunds to British Gilts.

- Pressure on Spain and Italy: The center-right PP party won a landslide victory in Spain’s general elections but bond yields put pressure on the government already before it was sworn in – 6.6% on 10 year bonds, once again. There are reports that Spain’s designated prime minister, Mariano Rajoy, has negotiated €100 billion of aid with Angela Merkel. 10 year yields remain high after last week’s bad bond auction. Italian bond yields are below 7% for now.

- Thanksgiving: US Markets are closed, making trade very thin and unexpected later in the day. This American holiday marks the beginning of the a lighter season in the markets, that will intensify towards Christmas and New Years. Here are tips for trading after Thanksgiving.

- China contracts: After one month above the critical 50 point level, the independent HSBC Manufacturing PMI fell into contraction zone, at 48 points. This is lower than the shallower drops seen earlier and casts a shadow all over the world. The dollar is stronger across the board and the euro suffers.

- Greece still awaits aid: The new technocrat Prime Minister Papademos, flew to Brussels in order to secure the long awaited 8 billion euros. The country will run out of money in mid December, according to the latest calculations, but these are doubted. The country will soon run out of money and the bank run can intensify.

- Euro/dollar swap like in 2008: The cost of swapping euros to dollar’s continues rising, and shows that banks continue paying a dear price for dollars. This is a reminder of 2008 and very worrying for the whole system. It reached another 3 year record.

- No debt reduction deal in the US: The US Supercommittee failed to reach an agreement regarding a long term debt reduction deal. The discussions and the announcement of the failure came with relative calm. As mentioned in the quarterly outlook, everything depends on the level of noise and not the actual result. Only Fitch is awaited and they might downgrade in the upcoming days, although the chances seem low.

- More OK US Data: After a big bunch of positive figures, the downgrade of Q3 GDP to 2% and also the Chinese slowdown make future US growth very uncertain. The meeting minutes revealed that some members still want to embark on QE3 but the big bulk of data released yesterday has shown that jobless claims continue ticking lower, and that core durable goods orders paint a positive picture.