Euro dollar is now trading in a narrow range awaiting the votes in the Italian parliament. There is a chance that Berlusconi might lose the votes and might be forced to resign. Italian bond yields continue soaring and this risks higher margin – the same path Greece, Ireland and Portugal went through. More meeting by finance ministers are due today.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

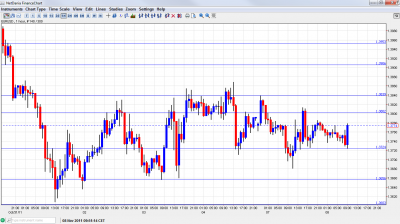

EUR/USD Technicals

- Further levels in both directions: Below 1.3725, 1.3650, 1.36, 1.3550, 1.35, 1.3450, 1.3360, 1.3250.

- Above: 1.38, 1.3838, 1.39, 1.3950, 1.4050, 1.4130, 1.42, 1.4250, 1.4282.

- 1.3650 is the clear bottom of the current range

- Strong resistance remains at 1.3838, which has a strong role.

Euro/Dollar in tight range – click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Trade Balance. Exp. 12.3 billion. Actual 15.3 billion. Positive surprise.

- 11:30 Debate begins in Italian parliament.

- 15:00 US IBD/TIPP Economic Optimism. Exp. 42.5 points.

- 18:00 FOMC member Narayana Kocherlakota talks.

- 18:30 US FOMC member Charles Plosser talks.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Italy under pressure: Silvio Berlusconi faces a vote on the 2010 finances and perhaps a confidence vote that could topple his government. We will see if the rebels in his party will really jump ship.

- Higher margins for Italy?: With rising bond yields, a repeat of what happened to Greece, Ireland and Portugal is on the cards. There are rumors that LHC Clearnet will soon raise the margins necessary for trading these bonds, and this will add more pressure. The euro-zone’s third largest economy is suffering from the bond vigilantes: ten year note yields remain at the highs of 6.68% while also 1 year notes are getting close to 6%. Two year yields get too comfortable above 6%. The rise in short term yields is very dangerous as Italy needs a lot of refinancing. The ECB is buying in the markets, but this is limited.

- Still awaiting a new Greek government: George Papandreou agreed to step down in favor of a coalition government led by his party. This government will aim to secure the second bailout program for Greece and will then call elections, probably in February. The politicians still haven’t agreed on an interim Prime Minister, so Papandreou gets to stay in the meantime.

- Recession coming to Europe: German industrial production and euro-zone retail sales are the latest worrying signs about the state of the European economies. The new president of the ECB oversaw a unanimous decision to cut the rates in the euro-zone to 1.25%. He seems less stubborn and more practical than his predecessor Trichet. Draghi also acknowledged the weak economic situation, said that forecasts will probably be downgraded and spoke about a mild recession. With rising Italian yields, we might see real QE in the euro-zone soon.

- US avoiding recession?: The fresh Non-Farm Payrolls report, with its revisions and the drop in unemployment join other figures and point to no recession in the US.