EUR/USD began the week with a slow grind downwards and lost the 1.30 line. The pair is now at low support. A German ECB member, Asmussen, removed the option of ECB flexibility towards Greece and said that the relative calm is deceptive. In Spain, mixed messages about taking the bailout were made. Some outrage was caused by one of Merkel’s top economic advisers, who said the blunt truth about the bailouts – helping German banks. The Eurogroup meets today but the main topic, Greece, will have to wait, at least after Merkel’s interesting visit to Athens tomorrow.

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

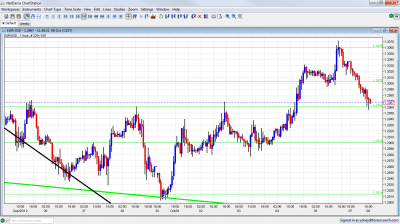

EUR/USD Technical

- Asian session: Euro/dollar slid from the highs and began a struggle with 1.30.

- Current range: 1.2960 to 1.30.

Further levels in both directions:

- Below: 1.2960, 1.2900, 1.2814, 1.2750, 1.2670, 1.2624, 1.2587, 1.2520 and 1.2460.

- Above: 1.30, 1.3060, 1.3105, 1.32, 1.3290, 1.34, 1.3437, 1.3480 and 1.3540.

- 1.3060 is a strong line on the upside.

- 1.2960 is a clear separator on the downside.

Euro/dollar sliding ahead of Merkel’s visit to Athens- click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German Trade Balance. Exp. 15.8 billion. Actual 18.3 billion.

- 8:30 Euro-zone Sentix Investor Confidence. Exp. -20.6. Actual -22.2 points.

- 10:00 German Industrial Production. Exp. -0.7%.

- From 13:00 Eurogroup meetings.

EUR/USD Sentiment

- Spanish anger: “When we rescue Spain and Greece, we are thinking about our banks” said Jürgen Donges, one of the 5 members in Germany’s economic council. Hearing a senior German official say this clearly caused anger in Spain. If his words continue to echo, it might delay the bailout request. And were does the bailout request stand? Spain’s deputy PM said the bailout is a question of “when” and not “if”, but other senior figures said that this decision depends on conditions, and that it might not be made. ECB president Mario Draghi made it clear that the central bank’s OMT program is ready for use for Spain, but Spain needs to ask for aid. While Spain is getting closer to such a move, the open question regarding direct bank recapitalization and the northern objection to act for “legacy” issues certainly contributes to the delay. Other reasons for a delay are the relatively lower yields (that could flip anytime) and regional elections on October 21st.

- Greek tensions: German chancellor Angela Merkel will make a bold visit to Athens on Tuesday. No less than 6,000 security personnel will be deployed to safeguard her visit, which will be “welcomed” by strikes and protest. In the meantime, there is little progress in negotiations between the troika and the Greek government. There was some talk that the ECB could accept a delay in payments or lower interest rates, but this was ruled out by Jörg Asmussen, a German member of the ECB which is considered close to the German government. He also said the current calm is “deceptive”. So, the next “deadline” is the EU Summit on October 18-19th.

- Strong NFP stirs political debate: The US gained 114K jobs in September, and revisions added an additional 86K. In addition, the unemployment rate fell to 7.8%, despite a rise in the participation rate – a figure that is very important for Bernanke. These goods figures were marred by a rapid gain in temporary jobs rather than permanent ones, and they stirred a political debate as elections are less than a month away. In general, the market favors Romney – a better showing by the Republican in the first debate helped markets and weakened the dollar.

- US Economy – zigzagging continues: The downwards revision of Q2 GDP was quite depressing and showed that the US economy is at stall speed. However, improvement from housing and a surprising drop in jobless claims are positive points. Both and The ISM Non-Manufacturing PMI easily beat the market estimate and the ADP Non-Farm Employment Change pushed higher for the third consecutive month. The US is on holiday today, so no indicators are released, and volume is expected to be lower.