Talking Points

- Euro continued its decline against the US Dollar, as there was a lot of bearish pressure on the shared currency.

- A new weekly low was formed for the EURUSD pair, as the pair traded towards 1.0800.

- German Factory orders released by the Deutsche Bundesbank posted a decline of 1.7% in September 2015, compared with the forecast of a 1% rise.

- Euro Zone Retail Sales released by the Eurostat declined by 0.1% in September 2015, whereas the market was expecting a rise of 0.2%.

EURUSD Technical Analysis

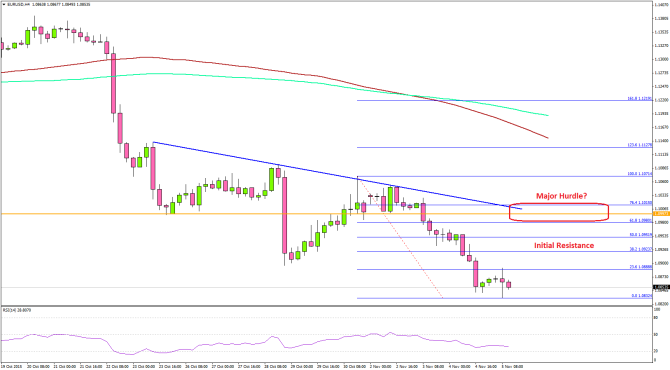

The EURUSD dived Intraday and traded towards the 1.0800-20 support area. A new weekly low was formed at 1.0832 where somehow buyers managed to protect any additional downsides. The pair is currently correcting higher, and facing resistance around the 23.6% Fib retracement level of the last drop from the 1.1071 high to 1.0832 low.

The 38.2% Fib level is the next area of selling interest. However, the most important resistance area can be around a bearish trend line formed on the hourly chart, coinciding with the 61.8% Fib level.

On the downside, a break below the recent low of 1.0832 might call for a move towards 1.0800.

Fundamentals

Today, there were a few major economic releases in the Euro Zone, including the Factory orders, which is an indicator that includes shipments, inventories, and new and unfilled orders was released by the Deutsche Bundesbank.

The forecast was lined up for an increase of 1% in September 2015, compared with the preceding month decline of 1.8%. The result was below the market expectation, as the German Factory Orders fell 1.7%. In terms of the yearly change, the German Factory Orders decreased 1% in September 2015, compared with the same month a year ago.

Similarly, the Euro Zone Retail Sales released by the Eurostat was also on the disappointing side, as it registered a decline of 0.1% in September 2015 compared with the forecast of 0.2%.

There was a rise in the bearish pressure on the shared currency after the releases, which might increase moving ahead.

“”””””””””””””””””””””””””””””””””””””””””””-

Article by Aayush Jindal, Market Analyst at Titan FX

“”””””””””””””””””””””””””””””””””””””””””””-