EUR/USD had an initial weak reaction to the ECB’s bond buying program, but eventually markets realized the big step forward and the pair broke above the triple top. It continues surging forward with a positive feedback loop with Spanish bonds. Hope for a resolution of Spain’s crisis is strong. The focus now shifts to the US, where expectations have risen for the Non-Farm Payrolls. It’s important to remember that this is a critical figure towards the FOMC meeting when it decides if to launch QE3 or not. This busy week will see a stormy finish.

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

EUR/USD Technical

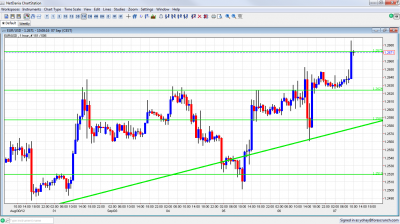

- Asian session: Euro/dollar consolidated the gains above 1.2624 and continued surging higher in the European session..

- Current range: 1.2670 to 1.2740

Further levels in both directions:

- Below: 1.2670, 1.2624, 1.2587, 1.2520, 1.2440, 1.24, 1.2360, and 1.2330.

- Above: 1.2743, 1.2814, 1.29, 1.2960, 1.30 and 1.3050.

- 1.2740 is the next line, but it isn’t that strong – 1.2814 is more important.

- 1.2624 now switches from strong resistance to strong support.

Euro/Dollar surges before NFP – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German Trade Balance. Exp. +15.5 billion. Actual 16.1 billion.

- 6:45 French Trade Balance. Exp. -5.7 billion. Actual -4.3 billion.

- 10:00 German Industrial Production. Exp. +0.1%.

- 12:30 US Non-Farm Payrolls. Exp. +123K. See how to trade this event with EUR/USD.

- 12:30 US Unemployment Rate. Exp. 8.3%.

- 12:30 US Average Hourly Earnings. Exp. +0.2%.

EUR/USD Sentiment

- ECB Announces OMT: We can safely say that Draghi delivered. The ECB presented the Outright Monetary Transactions program: unlimited bond buying of bonds up to three years in maturity, provided that the country asks for help. Draghi even lent Spanish PM Rajoy a helping hand by enabling bond buying also in case of a “precautionary program” – a soft bailout and not only a full adjustment one. The ECB left rates unchanged for now, but a cut is on the cards next month.

- Spanish yields tumble down: Investors are returning to Spain ahead of the ECB. Not only ECB targeted short term yields are falling: benchmark 10 year yields fell under 6%. Spanish PM Rajoy hosted German Chancellor Merkel in Madrid and Spain is getting closer to asking for aid. This will probably not come in today’s cabinet meeting, but next wee k, September 14th, after the German court rules and as European finance ministers convene. As aforementioned, Spain could opt for a “soft bailout”. After Catalonia asked for 5 billion euros of aid, also its southern neighbor joined in and banks are also tapping into the government’s limited resources. Also unemployment is on the rise.

- QE or no QE?: This Non-Farm Payrolls release could determine the fate of QE3 in September. Positive data is expected according to early signs, and this could trigger no QE3 from the Fed – this will result in a stronger dollar. If data disappoints, speculation will rise for more dollar printing. In a highly-anticipated speech at the central bankers’ meeting in Jackson Hole, Fed chief Bernanke dished out little more than what he’s been saying for months – the Fed was closely monitoring the US economy, and was willing to intervene and stimulate the economy with easing measures if conditions worsened. The bottom line? The Fed will stick to the sidelines and there will be no QE3 in September.

- German Court to Rule on ESM: On September 12th, Germany’s Constitutional Court will hand down a decision on the legality of the European Stability Mechanism as it stands for Germany. The court’s ruling is required in order to ratify the ESM proposal by EU officials. Opponents to the ESM say it is unconstitutional and will harm Germany’s economy. The Court is expected to vote in favor of the proposal, but we could see some fluctuation by the euro in the days prior to the decision, as a rejection of the proposal would be disastrous for the currency.

- Greece in disagreement as troika returns: Greece’s 3 coalition partners are still unable to agree on new austerity, as the troika delegation lands in Athens. In the meantime, anti-austerity parties gain traction in the polls, and unemployment figures are terrible, as the unemployment rate rose to a stagggering 24.4%, up from 23.5%.