EUR/USD is trading quietly on Friday, as the pair trades in the high-1.32 range in the European session. In economic news, the ECOFIN and Eurogroup will hold meetings on Friday. In the US, Unemployment Claims dropped sharply, but technical problems resulted in some claims not being processed. After just one major US release so far this week, there are four key events on Friday – Core Retail Sales, Retail Sales, PPI, and UoM Consumer Sentiment.

Here is a quick update on the technical situation, indicators, and market sentiment that moves euro/dollar.

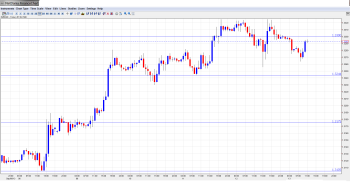

EUR/USD Technical

- In the Asian session, EUR/USD edged lower, touching a low of 1.3264 late in the session and consolidating at 1.3373. The pair is showing little change in the European session.

Current range: 1.3240 to 1.3300.

Further levels in both directions:

- Below: 1.3240, 1.3175, 1.31, 1.3050 and 1.30.

- Above: 1.3300, 1.3350, 1.3415, 1.3450, 1.3520, 1.3590 and 1.37.

- 1.3300 is providing weak resistance.

- 1.3240 is a weak support level. 1.3175 follows.

EUR/USD Fundamentals

- 9:00 Eurozone Employment Change. Exp. -0.2%.

- Day 1 – ECOFIN Meetings.

- Day 1 – Eurogroup Meetings.

- 12:30 US Core Retail Sales. Exp. 0.3%.

- 12:30 US Retail Sales. Exp. 0.5%.

- 12:30 US Core PPI. Exp. 0.2%.

- 12:30 US PPI. Exp. 0.2%.

- 13:55 US Preliminary UoM Consumer Sentiment. Exp. 82.6 points.

- 13:55 US Preliminary UoM Inflation Expectations.

- 14:00 US Business Inventories. Exp. 0.4%.

* All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Unemployment Claims Drop: US Unemployment Claims dropped on Thursday, but a Department of Labor spokesman said the decrease was due to computer upgrades in two states, which meant that not all claims were processed. Even so, unemployment claims are looking good. The four-week average, which is a less volatile gauge of unemployment claims, dropped to 321,000, its lowest level since 2007. If employment data continues to improve, we could see the Fed press the tapering trigger sooner rather than later.

- Markets Eye US key events: Friday is unusually busy, with four key US releases – Core Retail Sales, Retail Sales, PPI, and UoM Consumer Sentiment. The large number of market-movers means that traders can expect some volatility from EUR/USD after these releases. The markets are anticipating better numbers in August from Retail Sales and UoM Consumer Sentiment. If this happens, the US could get a boot against the major currencies, including the euro.

- Industrial Production slumps: The Eurozone continues to produce mixed data, and Thursday’s Eurozone Industrial Production releases were disappointing. Eurozone Industrial Production dropped from 0.7% in July to -1.5% in August, well below the estimate of -0.1%. This was the worst showing since October 2012. Italian Industrial Production also was a bust, declining -1.1% in August after a 0.3% gain in July. The markets had expected a gain of 0.3%. We could see the euro take a hit if manufacturing and industrial numbers don’t improve.

- Latvia welcomes Draghi: ECB head Mario Draghi was in Latvia on Thursday, where he will delivered remarks at the Bank of Latvia’s Economic Conference. The timing of the trip was not coincidental, as the Baltic country is set to join the Eurozone on January 1, 2014. The small country of just 2.4 million will be the 18th member of the zone. Latvia’s economy has been doing well, but public support for adopting the euro has been weak, with fears of rising prices and Eurozone contagion.

- Syrian strike on hold: The Syrian crisis has taken on a new twist, as US military action, which seemed a foregone conclusion in late August, is currently on the backburner. The US and Russia are spearheading intensive efforts to come up with a diplomatic solution to the crisis. Under the proposed plan, Syria would hand over its entire arsenal of chemical weapons to the international community to be destroyed. Speaking on US television earlier in the week, President Obama said that he would delay any military action as long as a diplomatic solution was possible, but that a strike against Syria was still on the table. If the diplomatic efforts gain momentum and the crisis eases, we could see the safe-haven dollar lose ground.

Further reading:

- EURUSD Could Be Forming A Major Turning Point For The Year-Elliott Wave Analysis

- Forex Analysis: EUR/JPY Continues Consolidation within Clear Triangle Pattern