June 30th is here: this is the double deadline for Greece: to pay the IMF and when the bailout expires. Last minute diplomacy is going on, but the focus is already on the Greferendum on Sunday.

After yesterday’s amazing recovery rally (5 reasons here), EUR/USD is changing course and sliding back down, back to Friday’s close. Updates:

Late in the European night, EC President Jean-Claude Juncker made a last minute proposal to Greece. This included a one month extension and talk of talk of debt restructuring in October. This offer was promptly rejected by Tsipras, who is set to vote NO.

In the meantime in Greece, the government made some adjustment to capital controls, especially regarding pensions. The banks remain closed for a second day.

European leaders made it clear that the referendum on Sunday is a referendum on euro-membership. This stance was echoed by Germany, France and Italy.

Greek crisis – all the updates in one place

Economic Data

Regarding economic data, we already had a beat in German retail sales: +0.5% instead of 0% expected. French consumer confidence fell short with 0.1% instead of 0.3% expected. The big event of the day in terms of data is the release of German unemployment.

Low German employment means a popular and confident Chancellor Merkel. This has an indirect impact on German policy.

We also have inflation data from the euro-zone. These are expected to show lower inflation. They are important as well, especially regarding wider ECB policy, but the focus today is on Greece.

EUR/USD

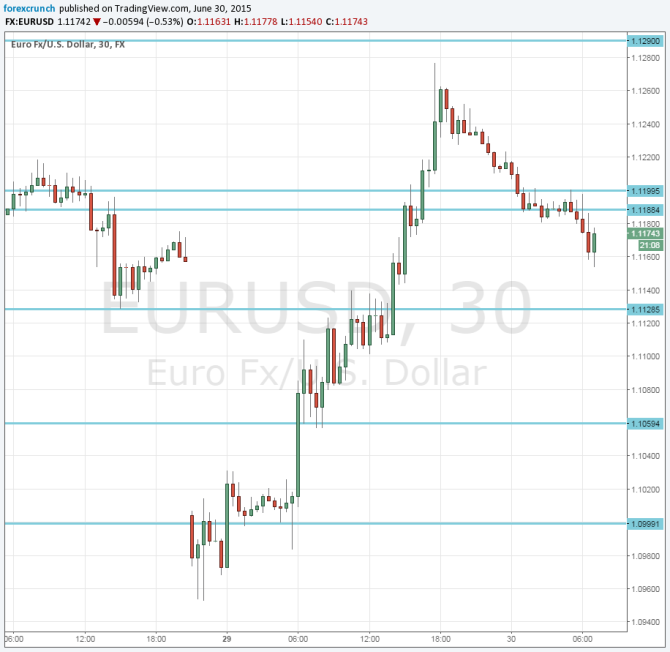

1.1160 currently serves as support, and this is followed by 1.1050. Resistance awaits at 1.1290.

Here is how it looks on the chart: