The euro dropped quite a lot against the dollar in 2014. What’s on the road ahead for the upcoming 2 years?

The team at Citi take a long term view:

Here is their view, courtesy of eFXnews:

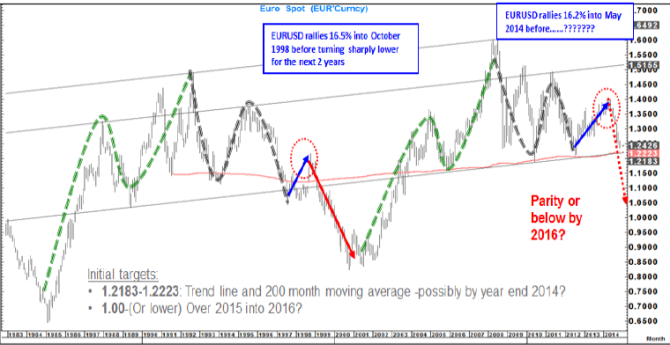

CitiFX Technicals is out with a very interesting long-term chart for EUR/USD suggesting that the pair should find some initial support in the 1.22 area and pointing to 2 long-term targets for the pair’s downtrend:

1- 1.2183-1.2223 trend line and 200 month moving average – Citi sees these targets possible by end of this year.

2- Parity or below. Citi projects these targets over 2015 and into 2016.

In its portfilio, Citi maintains short EUR/USD targeting 1.22 and below.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.