EUR/USD shot to higher ground, riding on 3 global worries. What will drive it next?

The team at Danske explain all the moving parts and why they remain short:

Here is their view, courtesy of eFXnews:

The increasingly hesitant stance from the FOMC is challenging our long-held view that USD should continue to strengthen ahead of a first hike this year.

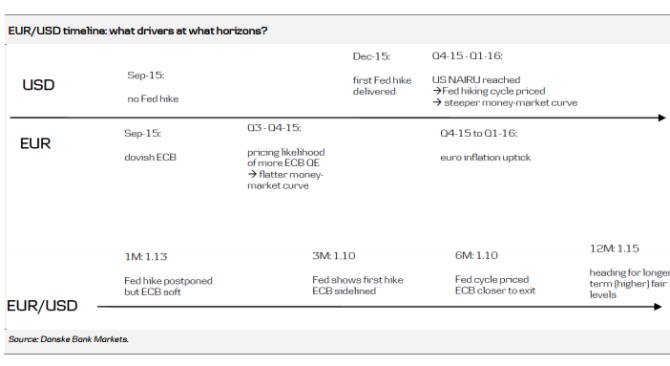

With our call for a first Fed hike postponed to December, we see potential for dollar strength much reduced from here. Albeit we still look for some (limited) dollar strength over the autumn, we now emphasise that the EUR/USD low (March 2015) is most likely behind us.

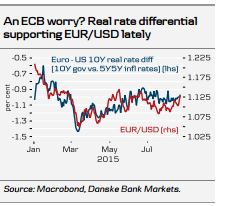

We largely agree with the market in terms of the timing of a first rate hike, and thus the main source of USD strength heading into 2016 is set to come from a re-pricing of the US money-market curve: we still see potential for a somewhat more aggressive pricing of Fed hikes in early 2016 – even if this cycle will clearly be much more shallow than has been the case historically.

Moreover, while we have previously argued that the Fed would largely stay out of the currency war, the cautious stance from the FOMC lately suggests that the (historically) strong USD is increasingly a worry for the Fed. The significant change in Chinese exchange-rate policy early August clearly aggravates the situation in this respect.

Speculative positioning still being stretched on USD longs and the likelihood of no Fed hike in September suggest USD crosses could come under pressure near term. However, with the Fed set to signal that a hike is still looming, we do not envisage a longer USD sell-off.

Specifically for EUR/USD, the ECB September meeting will be essential for a direction in the pair heading into the autumn. We expect Draghi to adopt a dovish tone on 3 September following the marked drop in oil prices and in inflation expectations lately. While this should not come as a major surprise we think the euro could come under pressure from verbal ECB intervention over the autumn to curb the drop in inflation expectations and thus speculation of a QE extension.

Notably, the ECB will not want to see the euro strengthen – and definitely not if associated with oil heading lower still. But, importantly, we do not expect new ECB measures to be announced, and heading into 2016 the uptick in euro-zone inflation will become the dominant market theme, even with oil prices set to hover just above the USD55/bl mark.

A first Fed hike in December and a re-pricing of the Fed following in Q1 next year should still lend support to USD but this will happen at a time when an ECB QE exit is moving closer. As a result we see EUR/USD largely trendless on a 3-6M horizon with trading set to be concentrated in the 1.08-1.12 interval.

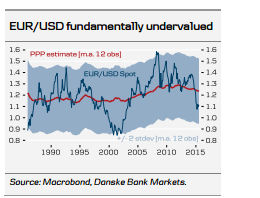

Further out, we maintain our long-standing view that EUR/USD will head higher towards levels warranted by medium- to long-term fundamentals, including current account trends and valuation.

We have revised our EUR/USD forecast to: 1.13 in 1M (prev. 1.08), 1.10 in 3M (1.06), 1.10 in 6M (1.08), and 1.15 (1.10) in 12M. We remain short EUR/USD in our Danske FX Trading Portfolio as we still expect a down-move over the coming 3 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.