The poor jobs report in the US left the dollar vulnerable and other currencies celebrating against the greenback. What’s next?

Here is their view, courtesy of eFXnews:

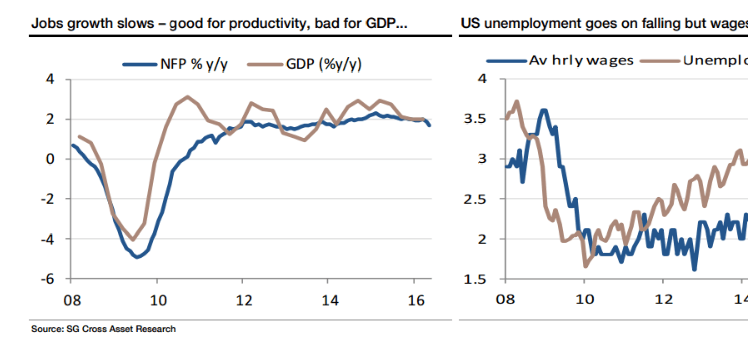

The BLS has shot the albatross: The market reaction to the jobs data is to abandon HMS RateHike, stuck in the Doldrums, and head for the life-rafts. Those friendly economic winds which supported the dollar and the notion of a summer rate hike have vanished and left the foreign exchange becalmed.

The dollar rallied by 15% on a trade weighted between July 2011 and January (since when it’s down4%. Over 5 years, It’s sup against every other major currency, and the three biggest losers (the Brazilian real, Russian rouble and South African rand) have all halved their value over 5 years.. Of the G10, second best is the pound, down 10%, while the Norwegian Krone has lost almost a third of tis value and this year’s star, the yen, has lost over 25%. But over the last year, things have mostly been quiet. Sure, the yen has rallied a lot, up by nearly 17% y/y, as it recovers ground lost in the Abe era.

But EUR/USD is within 1% of where it was a year ago, a year during which it has averaged 1.11, and meandered pretty aimlessly between 1.05 and 1.17.

I don’t think USD/JPY will move as much in the next year as it did so far ion 2016, and I doubt that EUR/USD will get outside the range of the last year in the next one, either.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.