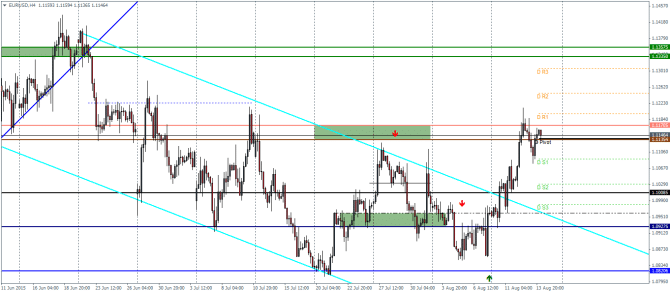

EURUSDUpdateEURUSD Daily Pivots

| R3 | 1.1306 |

| R2 | 1.1245 |

| R1 | 1.1197 |

| Pivot | 1.1137 |

| S1 | 1.1089 |

| S2 | 1.1029 |

| S3 | 1.098 |

EURUSD (1.1): EURUSD has been trading around the resistance level of 1.117 and 1.1135 for most of yesterday. On the daily charts, price action shows a pending test of support at the newly broken lower resistance at 1.104 which if successful could see EURUSD break the current resistance. To the upside, the next main resistance level is at 1.13575 – 1.1335 which could be tested on a successful break above 1.117 and a potential test of support at this level as well. To the downside, a break below the new support at 1.104 could see a decline to 1.10 round number for test of support.

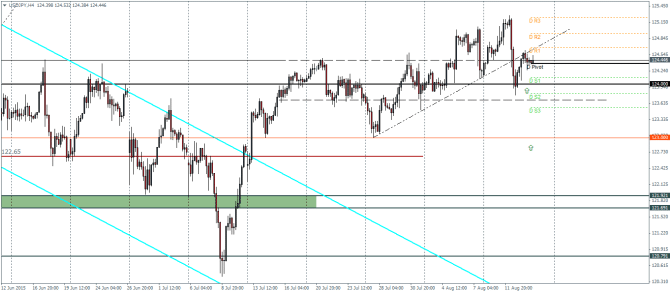

USDJPY Daily Pivots

| R3 | 125.237 |

| R2 | 124.935 |

| R1 | 124.678 |

| Pivot | 124.376 |

| S1 | 124.119 |

| S2 | 123.817 |

| S3 | 123.56 |

USDJPY (124.4): USDJPY has been consolidating near the horizontal resistance at 124.44 and the broken trend line. A decline to the lower support at 124 could see a possible sideways price action take place. To the downside, a break below 124 will see the next support at 123.7 which could attempt to hold prices and the support failure here could see a decline down to 123. To the upside, a test from 124 will likely see a break above the current resistance at 124.44.

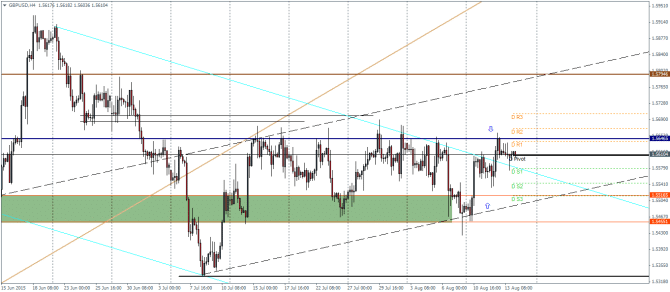

GBPUSD Daily Pivots

| R3 | 1.5703 |

| R2 | 1.5669 |

| R1 | 1.5640 |

| Pivot | 1.5607 |

| S1 | 1.5578 |

| S2 | 1.5544 |

| S3 | 1.5514 |

GBPUSD (1.56): GBPUSD remains range bound and stuck near the resistance level of 1.56465. A break above this resistance is needed to see further gains to the upside. To the downside, another test towards 1.55165 support is very likely but could weaken the upside bias. Price is however trading outside the falling price channel and thus we can anticipate a possible break out to the upside in the near term.