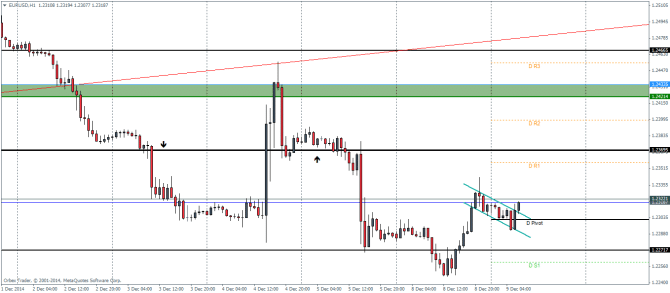

EURUSD Daily Pivots

| R3 | 1.2454 |

| R2 | 1.2398 |

| R1 | 1.2357 |

| Pivot | 1.2309 |

| S1 | 1.2260 |

| S2 | 1.2204 |

| S3 | 1.2163 |

EURUSD staged a very decent reversal from the major support level at 1.22717 albeit managing to trade below this support for a few hours. Current price action is forming out to be a bullish flag pattern, which gives an upside target to 1.23791 – 1.23695 levels. This is the same price zone that had briefly acted as support in the past. A test of this level for resistance could see EURUSD start to decline. However, a rally to retest the major resistance at 1.242 is also likely.

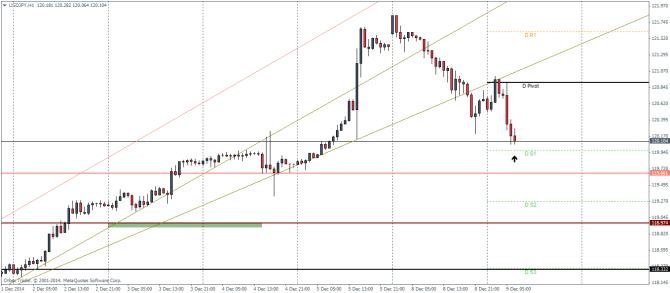

USDJPY Daily Pivots

| R3 | 123.256 |

| R2 | 122.55 |

| R1 | 121.618 |

| Pivot | 120.912 |

| S1 | 119.98 |

| S2 | 119.274 |

| S3 | 118.342 |

USDJPY broke down from the two trend lines to test the support at 120.845 levels. A quick rally to retest the broken trend line is indicative of a possible sharper decline to the next support level at 119.66. A major long term untested support does however sits at 118.974 which could be a good price level potentially attracting new buyers into the market.

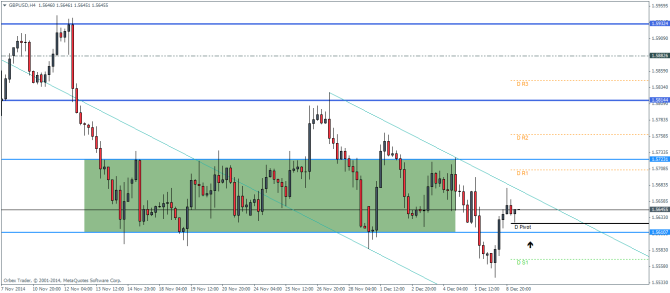

GBPUSD Daily Pivots

| R3 | 1.5844 |

| R2 | 1.5761 |

| R1 | 1.5706 |

| Pivot | 1.5623 |

| S1 | 1.5569 |

| S2 | 1.5486 |

| S3 | 1.5431 |

GBPUSD managed to stage a rally to 1.5611 levels as noted in yesterday’s analysis. Current price action is critical as 1.5611 could potentially be tested for support, which would push the GBPUSD higher. A minor price channel plotted in the GBPUSD will be critical, as a break above the upper resistance line could pave way for yet another test to 1.572, following a rally to 1.581 on breakout from the congestion zone.